2015 Q4 & Full-Year Results

Paris, France | Mar 3, 2016

In Difficult Market Conditions

- High Q4 multi-client sales

- Solid 2015 EBITDA at $661m

- Successful €350m capital increase

FY 2015: Positive Operating Income1 and Solid EBITDAs1 Driven by a Strong Q4

- Revenue at $2,101m

- EBITDAs1 at $661m driven, as expected, by a strong Q4 at $282m

- Group Operating Income1 at $19m

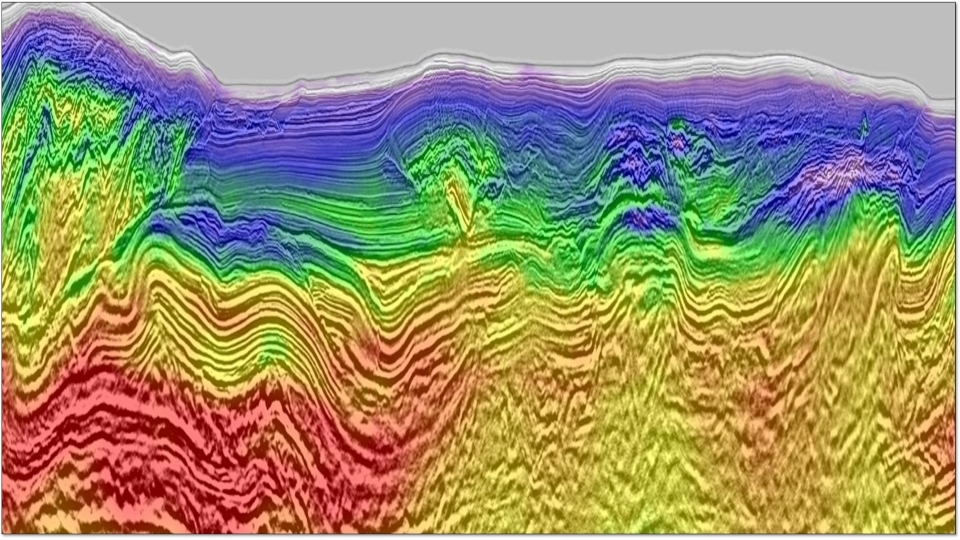

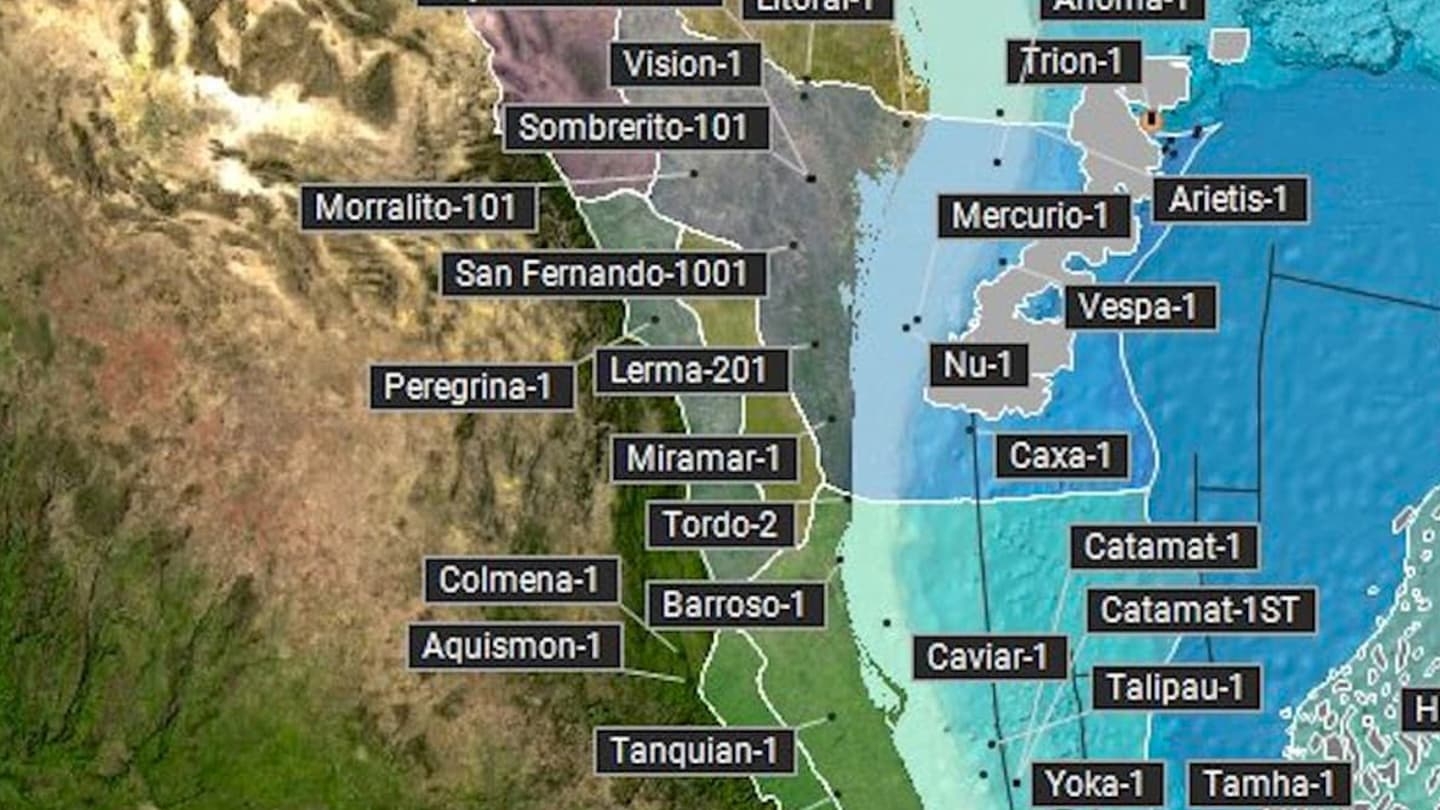

- GGR: solid operational margin at 22.2% with resilient multi-client volumes and a strong cash prefunding rate of 102%

- Contractual Data Acquisition: (25)% operating margin impacted by severe marine market conditions

- Equipment: a 6% operating margin with low volumes

- Net income at $(1,446)m after $(1,177)m impairment and non-recurring charges

- Capex down 52% y-o-y, at $415m and Free Cash Flow1 at $(9)m

- Net debt at $2,500m corresponding to a leverage ratio at 3.8x

Transformation Plan: Implementation on Track, Refinancing Completed and Successful Capital Increase

- Transformation Plan on track: Marine fleet reduced to 8 vessels end-2015. Total reduction since 2013 year-end of (64)% in marine costs, (54)% in G&A expenses, Capex divided by two and departure of 3,700 employees

- Successfully issued a $342 m secured 2019 Term Loan to refinance 94% of HYB 2017 and Fugro Loan

- Full reset of Financial Covenant and extension of French RCF to mid-2018

- Successful completion of €350m rights offering leading to a year-end 2015 Group Liquidity at $791m, on a pro-forma basis

2016 Outlook: Focus on Cash Management in a Still Difficult Environment

- GGR to represent over 60% and Contractual Data Acquisition down to less than 15% of future Group revenue, with a fleet down to 5 vessels by end of Q1

- 2016 capex: Industrial at $100/125m and cash multi-client at $325m/$375m with prefunding rate above 70%

- Year-end net debt targeted below $2.4bn

[1 - Figures before Non-Recurring Charges related to the Transformation Plan]

PARIS, France – March 3rd 2016 – CGG (ISIN: 0000120164 – NYSE: CGG), world leader in Geoscience, announced today its 2015 fourth quarter and full-year results.

Commenting on these results, Jean-Georges Malcor, CGG CEO, said:

“In a very difficult market environment, CGG has delivered a satisfactory level of EBITDAs in the fourth quarter of 2015, due to the strong performance of its multi-client library and the resilience of its Equipment segment.

In 2015, with a sustained level of EBITDAs at 661 million dollars and good discipline in Capex spending, free cash-flow generation improved significantly compared to 2014, underlining our consistent efforts to preserve cash throughout the year.

At the same time, the Group refinanced its debt and successfully completed a capital increase of 350 million euros in February 2016. This enables CGG to start 2016 with $791m liquidity on a pro-forma basis.

2016 will remain difficult with a very weak start of the year. In this context, the Group is resolutely implementing its Transformation Plan, particularly with the reduction in its fleet to 5 vessels by the end of the first quarter of 2016. Contractual Data Acquisition will gradually decline to less than 15% of Group revenue, while GGR will represent more than 60 %. By implementing very rigorous cash management, we target a net debt of less than 2.4 billion dollars by the end of the year.

CGG is refocusing on its high-added value Geoscience businesses while reducing its exposure in its cash-burning activities. In the current, strongly deteriorated market conditions, I would like to emphasize the strong mobilization of all our employees to even better serve our clients and provide solutions to their new challenges, with the same standards of reliability and excellence.”

Fourth Quarter 2015 Results

- Revenue at $589m, up 25% sequentially

- Operating income, before Non-Recurring Charges (NRC), at $21.1m

- EBITDAs at $281.6m, and positive Free Cash Flow before NRC at $52m

- Following the strong deterioration in market conditions and our implementation of the new step in our Transformation Plan announced in November 2015, Non-Recurring Charges of $(187)m were booked in Q4 as restructuring costs, mainly related to redundancies

- Net Income at $(256)m after NRC

Post-Closing Events

Successful completion of a €350m rights offering on February 5th 2016 related to the new step in our Transformation Plan. CGG capital is now made up of 708,260,768 shares.

Following the completion of the rights offering, effectiveness of the amendment and restatement of the US and French Revolving Credit signed on January 10th 2016.

*For full financial records, please reference the Investors section of this website.*