CGG Announces its 2019 Fourth Quarter Results

Paris, France | Mar 6, 2020

Strong Q4 2019: 18% segment operating income margin and $26m net income

Strong Operational Performance & High Cash Generation in 2019

2020: Reinforcing our leadership position

Well on-track for our 2021 financial targets

CGG (ISIN: FR0013181864 – NYSE: CGG), world leader in Geoscience, announced today its 2019 third quarter unaudited results.

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:“During 2019, while delivering a strong financial performance, we achieved several key milestones on our strategic path to becoming a People, Data, Technology company. For 2020, we plan to grow our investments to further increase our technology differentiation and build the foundation for our future sustainable growth, however we will adapt our plans to market conditions. Moving forward, we expect to continue generating significant cash. I am confident that with our new technology-driven business model, we are on track to achieving our 2021 strategic and financial targets."

Q4 2019: Results in line with expectations

IFRS figures: revenue at $426m, OPINC at $74m, net income at $26m

Segment revenue at $396m, down 9% year-on-year

Geoscience: stable activity supported by high-end projects

Multi-client: solid level of after-sales despite a very high Q3 2019

Equipment: 15% year-on-year growth driven by robust sales on land equipment deliveries

Segment EBITDAs at $206m, down 12% year-on-year , a high 52% margin driven by solid profitability of all businesses

Segment operating income at $72m, including $(33)m impairment of the multi-client library, a high 18% operating income margin

Net Income from new profile at $63m

Net Cash Flow of $6m

Full Year 2019: Strong Revenue and EBITDA growth year-on- year

IFRS figures: revenue at $1,356m, OPINC at $244m, net loss at $(61)m

Segment revenue at $1,400m, up 14% year-on-year

Segment EBITDAs at $721m, up 30% year-on-year, a 51% margin

Segment operating income at $247m, up 74% year-on-year, a 18% margin

Net Income from new profile at $126m

High Cash Generation with Strong Financial Position at year-end 2019

FY 2019 new profile segment Free Cash Flow of $434m, before cost of debt and including a positive change in working capital and provisions of $58m

FY 2019 Net Cash Flow of $186m after multi-client cash capex at $(186)m with cash prefunding rate of 118% and Industrial and R&D capex at $(75)m

Net debt of $584m before IFRS 16 at the end of December, cash liquidity of $610m

Leverage ratio Net Debt/ EBITDAs at 0.9x (before IFRS 16)

2020 Guidance: Increased Investment to Reinforce Leadership Position

Mid-single digit Segment Revenue growth compared to 2019, excluding one-off transfer fees of $50m, assuming limited impact of the Coronavirus (COVID-19). We continue to monitor the situation and potential impact on our business as our clients might re-evaluate their plans in the context of oil price volatility

EBITDAs margin stable at around 50% compared to 2019, excluding positive impact of one-off transfer fees

OPINC margin stable at around 15% compared to 2019, excluding positive impact of one-off transfer fees and including higher multi-client amortization of around $350m

Investments of $365-400m, a $100-125m$ increase year-on-year

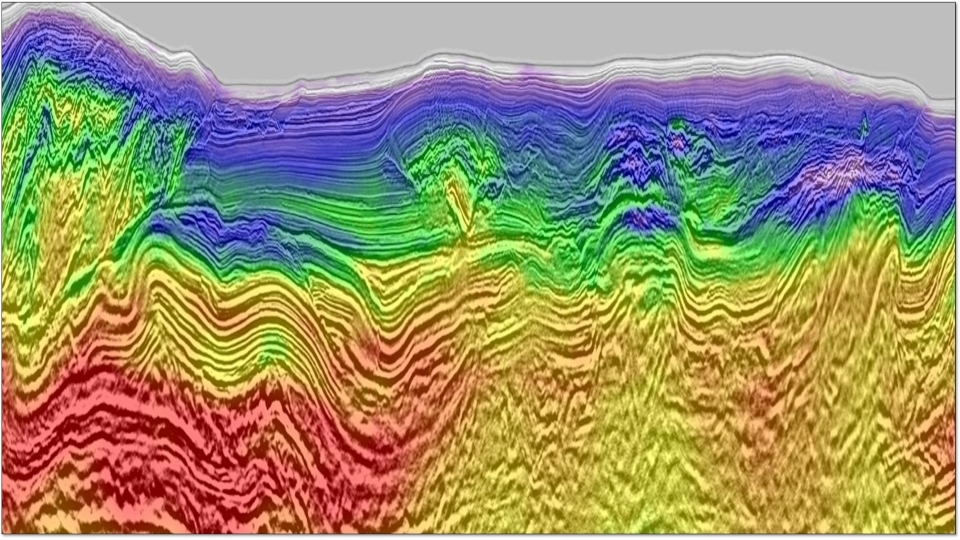

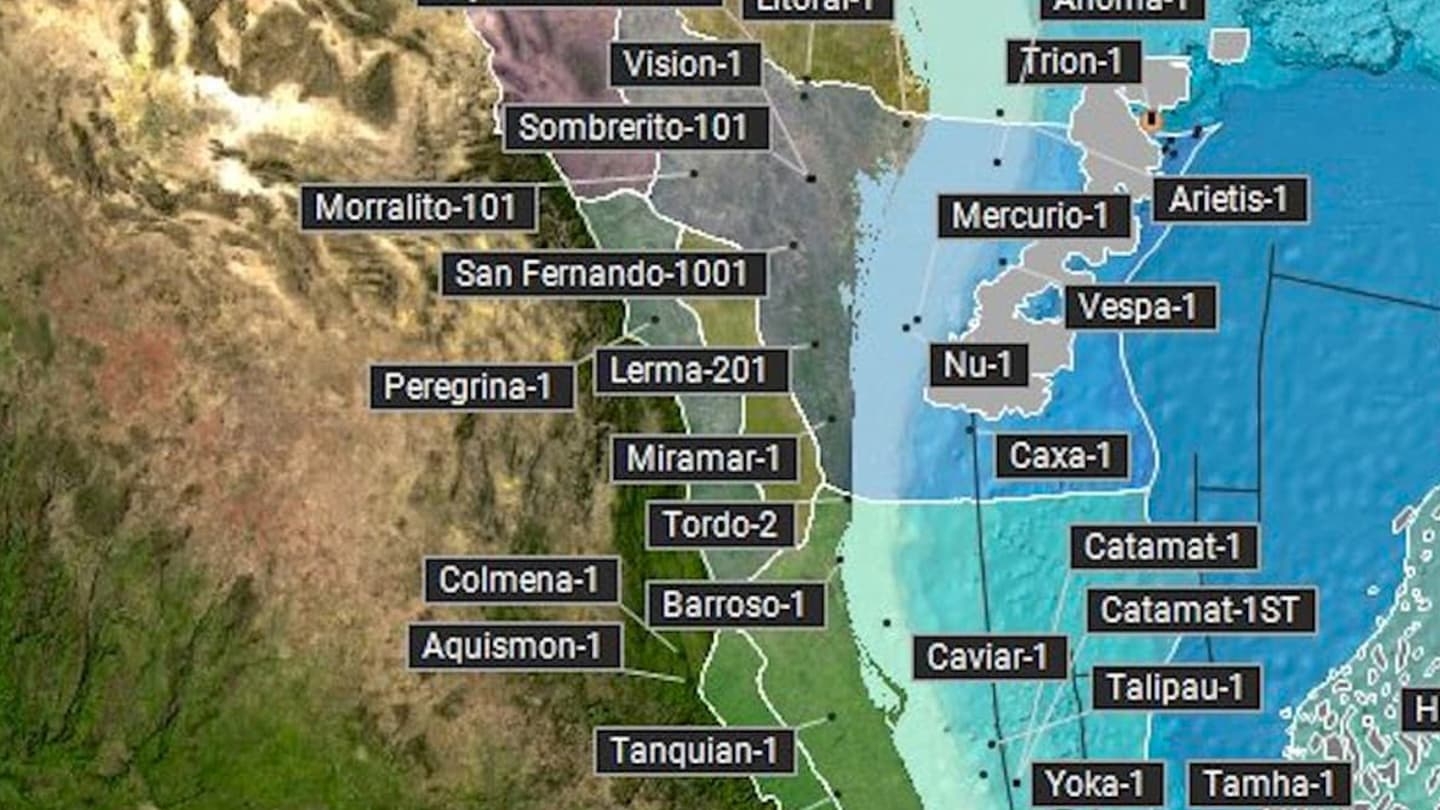

Multi-client cash capex at $275-300m with cash prefunding rate above 75%, sustained by a solid pipeline of well-prefunded multi-clients programs

Industrial and R&D capex at $90-100m

Solid cash generation, with segment Free Cash Flow in the range of $175-200m, including $100-125m increase in investments and negative change in working capital of c. $(80)m reflecting return to usual seasonality profile with strong Q4 multi-client and equipment sales

Positive Net Cash Flow including $(70)m Plan 2021 cash costs and cash costs of debt

Post closing events:

Marine acquisition exit: on January 8 2020, CGG announced that it has completed exit from marine acquisition business by closing its strategic partnership transaction for marine seismic acquisition with Shearwater GeoServices Holding AS (Shearwater).

Land acquisition wind down: on February 18 2020, CGG announced that it has fully withdrawn from the land seismic data acquisition business after completing its last land seismic acquisition contract in Tunisia.

Multi-Physics acquisition: Memorandum of Understanding signed early February.

*For full financial records, please reference the Investors section of this website.*

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).