CGG Announces its 2020 Second Quarter Results

Paris, France | Jul 29, 2020

A quarter impacted by Covid-19 and oil price drop

Swiftly aligning cost structure to the new baseline

CGG (ISIN: FR0013181864), a world leader in Geoscience, announced today its 2020 second quarter unaudited results.

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:“The geoscience market continued to deteriorate this quarter as clients reprioritized portfolios to factor in reductions in E&P spending. Our priority remains the safety of our employees, preservation of cash and maintaining excellent business continuity despite the global spread of Covid‐19. We are swiftly taking actions necessary to align our cost structure with the new baseline, while maintaining focus on our differentiated technologies and key multi‐client investments. With our strong balance sheet and solid strategy and plans, I am confident that CGG is well positioned to successfully navigate through these crises while best supporting our clients’ production optimization, reservoir evaluation and near field exploration challenges."

Q2 2020: Revenue and EBITDAs impacted by the crises

IFRS figures: revenue at $239m, OPINC at $(32)m, net income at $(147)m

Segment revenue at $202m, down 41% year-on-year

Geoscience: Resilient despite backlog decline

Multi-client: Supported by ongoing well prefunded projects in mature basins

Equipment: Reduced demand with some delays in deliveries due to Covid-19

Segment EBITDAs at $68m, down 60% year-on-year, a 34% margin

Segment operating income at $(53)m

Supplementary information

Adjusted* Segment EBITDAs at $76m before $(7)m of Covid-19 plan costs, down 56% year-on-year, a 37% margin

Adjusted* Segment operating income at $(5)m before $(49)m of non-recurring charges, including $(17)m fair value adjustments and limited $(24)m goodwill impairment

*Adjusted indicators represent supplementary information adjusted of non-recurring charges triggered by economic downturn and unprecedented drop in oil price.

Sound Liquidity

Liquidity of $546m and Net debt before IFRS 16 of $626m at June 30, 2020

Q2 2020 Segment Free Cash Flow of $(8)m

Q2 2020 Net Cash Flow of $(77)m, including $(25)m 2021 plan and Covid-19 plan cash costs

H1 2020 Net Cash Flow of $(60)m, including $(54)m 2021 plan and Covid-19 plan cash costs

*For full financial records, please reference the Investors section of this website.*

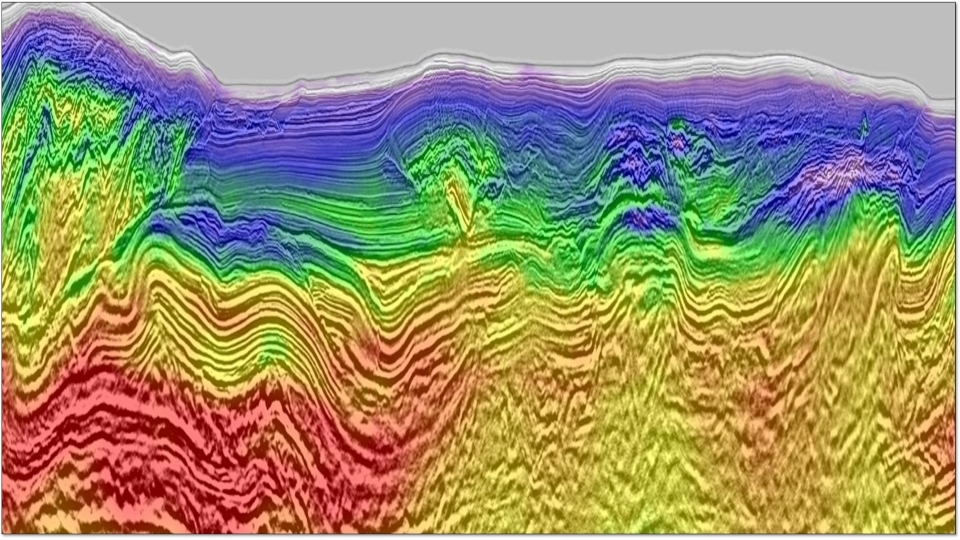

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).