CGG Announces its Q2 2021 Results

Paris, France | Jul 28, 2021

Soft quarterly revenue

Recovery anticipated in H2

Asset monetization progressing as planned

CGG (ISIN: FR0013181864), a world leader in Geoscience, announced today its second quarter 2021 non-audited results.

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:

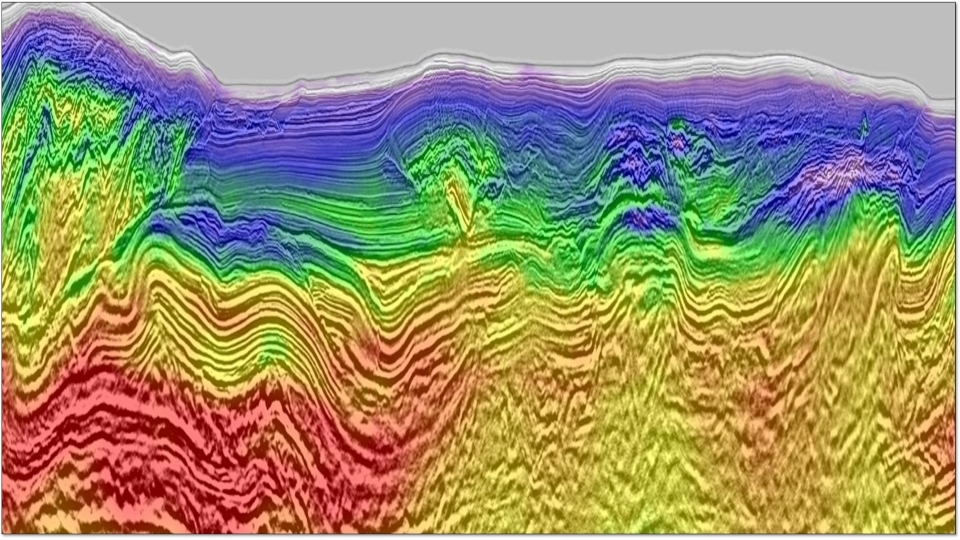

“During the first half of the year, the oil price environment has become more favorable. However, this has not translated yet into increase in geoscience-related spending by our customers. Considering the lack of investments by E&P companies, the need to increase spending, to better understand the subsurface and develop new opportunities, has continued to grow. Among our three businesses, Multi-client has been the most affected by the spending delays. Looking forward, following the soft first half of the year, activity is expected to strengthen in the second half of 2021 and onwards. With its high-end Geoscience and Equipment technologies, and superior quality Multi-client data in the world’s most attractive basins, CGG is well positioned to provide our clients with the solutions they require to increase the effectiveness of their activities, while meeting their ESG goals. In this environment, technology innovation, business diversification, and cash generation, remain our top priorities.”

Q2 2021: A soft quarter for Multi-client and Equipment

- IFRS figures: revenue at $172m, EBITDAs at $56m, OPINC at $(1)m

- Segment revenue at $157m, down (22)% year-on-year and down (26)% sequentially

- Geoscience segment revenue at $73 million, down (12) % year-on-year and up 11% sequentially

- Multi-Client segment sales at $37 million, including $20 million after-sales, down (40)% year-on-year and up 8% sequentially

- Equipment segment sales at $48 million, down (19)% year-on-year and down (58)% sequentially

- Segment EBITDAs at $42m and Adjusted* Segment EBITDAs at $35m, a 22% margin due to unfavorable revenue mix

- Segment Operating Income at $(7)m and Adjusted* Segment Operating Income at $(15)m

- Group Net loss at $(51)m

- Net Cash Flow at $(56)m before $(39)m of fees related to the refinancing

More:

Download Full Press Release (PDF, 222 KB, 20 pages)

Download Presentation (PDF, 1.7MB, 25 pages)

Q2 2021 Conference call

An English language analysts’ conference call is scheduled today at 8:00 am (Paris time) – 7:00 am (London time)

To follow this conference, please access the live webcast:

| From your computer at: | www.cgg.com |

A replay of the conference will be available via webcast on the CGG website at: www.cgg.com.

For analysts, please dial the following numbers 5 to 10 minutes prior to the scheduled start time:

|

France call-in: |

+33 (0) 1 70 70 07 81 |

|

|

|

UK call-in: |

+44(0) 844 4819 752 |

|

|

|

Access Code: |

9761434 |

|

|

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).