CGG Announces its Q3 2022 Results

Paris, France | Nov 2, 2022

Soft Q3 as clients’ projects shifted to Q4 and 2023

2022 segment revenue expected to be around $900m, stable pro-forma year-on-year

2022 segment EBITDAs expected to be around $380m, up 10% and up 15% pro-forma year-on-year

Strengthening market confirms favorable upcycle

CGG (ISIN: FR0013181864), a global technology and high-performance computing (HPC) leader announced today its third quarter 2022 non-audited results.

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:

“Throughout the year we continued to see our market environment strengthening globally, mainly driven by increased interest and activity offshore in the Western hemisphere and onshore in the Middle East and North Africa. While stronger market conditions have led to increased commercial activity, confirming the expected multi-year upcycle, near-term macro and geopolitical uncertainties resulted in increased volatility and clients’ projects shift. This particularly affected our Sensing and Monitoring business, which will see significant growth in 2023. However, our Data, Digital and Energy transition business remains solid with growth in line with increased E&P Capex. We anticipate a strong Q4 led by Earth Data sales. We remain focused on capturing the upcycle ahead of us and increasing our topline, with the objective of deleveraging our balance sheet. This growth will be supported by our clear technology differentiation, strong focus on our clients’ priorities, and the ongoing development of our Beyond the Core businesses.”

Q3 2022: A soft quarter as clients’ projects shifted to Q4 and 2023

- IFRS figures: revenue at $255m, EBITDAs at $115m, OPINC at $28m

- Segment revenue at $217m, down (20%) and down (16)% pro-forma* year-on-year.

- Geoscience at $69m, up 8% pro-forma* year-on-year mainly driven by Western hemisphere and high-end technology. The increasing level of year-to-date commercial bids worldwide by 26% and growth of year-to-date order intake by 37% pro-forma year-on-year are clear and positive signals of global market improvement.

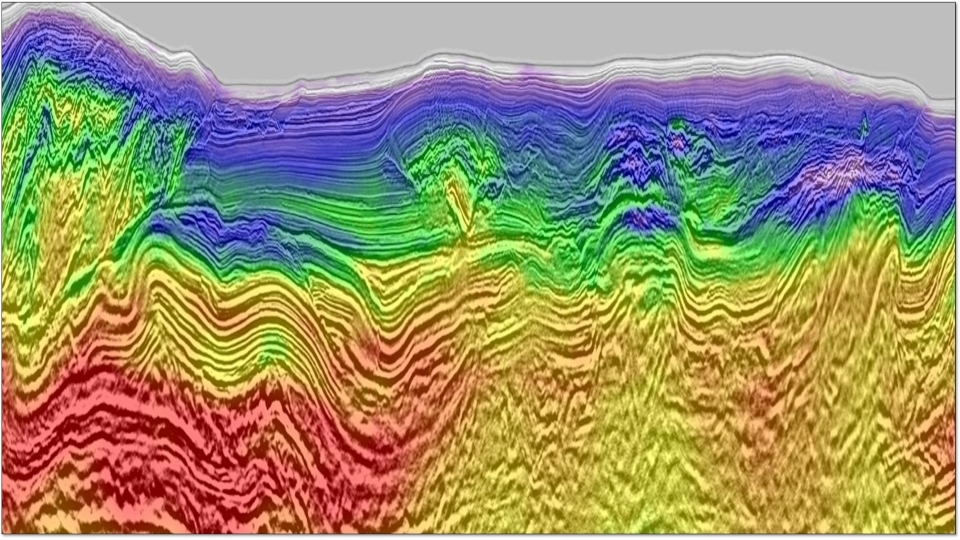

- Earth Data at $62m, down (33)% year-on-year. Prefunding revenue at $19m was lower than expected due to the shift of some prefunding of North Sea projects from Q3 to Q4 and Brazil projects into 2023. After sales were at $43m, up 32% year-on-year.

- Sensing and Monitoring at $86m, down (15)% year-on-year. In contrast to this, SMO level of commercial bids at the end of September was at the highest level since 2016, and several contracts and deliveries in the Middle East and North Africa shifted to 2023.

- Segment EBITDAs at $77m, a 35% margin and adjusted** segment EBITDAs at $75m

- Segment operating income at $25m, a 12% margin, and adjusted** segment operating income at $24m

- Group net loss at $(2)m, a significant improvement compared to a net loss of $(16)m last year

- Net cash-flow before M&A cash consideration at $(62)m

- Net cash flow at $(78)m, including $(19)m net payment for the acquisition of ION software division and $(40)m negative change in working capital, mainly related to the SMO business.

More:

Q3 2022 Conference call

An English language analysts conference call is scheduled today at 6.30 pm (CET)

The press release and the presentation are available on our website www.cgg.com at 5:45 pm (CET)

Please note that we have switched to a new service provider for conference calls.

Participants should from now on register for the call here to receive a dial-in number and code or participate in the live webcast from here.

A replay of the conference call will be made available the day after for a period of 12 months in audio format on the Company's website www.cgg.com.

About CGG

CGG (www.cgg.com) is a global technology and HPC leader that provides data, products, services and solutions in Earth science, data science, sensing and monitoring. Our unique portfolio supports our clients in efficiently and responsibly solving complex digital, energy transition, natural resource, environmental, and infrastructure challenges for a more sustainable future. CGG employs around 3,300 people worldwide and is listed on the Euronext Paris SA (ISIN: 0013181864).