CGG Communication Following S&P Rating

Paris, France | Feb 26, 2016

On November 16th, following the announcement by CGG of a next step of its Group’s Transformation, S&P downgraded CGG’s corporate rating to CCC+ with a Negative Outlook reflecting the rating agency’s view that the Company could notably face liquidity issue in the first half of 2016, breach its covenants, be unable to repay its 2017-2018 debt installments and be unable to benefit from the cash injection needed to finance its Transformation Plan. Since then, less than three months later, CGG has totally fulfilled all these requirements as highlighted below, which were also, the conditions set forth for upside revision of the Outlook. Today S&P reiterated its rating, the negative outlook, and downgraded further CGG’s unsecured debt, in the light of adverse market conditions.

CGG takes note of this position and would like to highlight what has been achieved so far from an operational and credit point of view during the last six months and provide clarification about S&P’s various statements.

1. New CGG Profile

S&P’s states that “CGG’s key business strengths include the company’s important global position and diversity”.

CGG wishes to emphasize the following points. In November, CGG announced the next step of its Group’s Transformation Plan which corresponded to a drastic reduction in its exposure to the contractual marine data acquisition market. With this Plan, 60% of the Group’s future revenue will come from GGR, 25% from Equipment while Contractual Data Acquisition will only account for 15%. CGG is refocusing on high added-value businesses to become strongly cash-generating and benefit from the immediate impact of the drastic reduction in its cash-burning activities. With this new company profile, CGG can no longer be compared to any of the pure marine or data acquisition seismic players.

- Fleet Structure

S&P takes into account the “intensely competitive nature of the seismic industry” and is viewing “the seismic industry as highly cyclical, notably (in) the capital-intensive offshore marine segment”.CGG is also convinced that the contractual data acquisition market will remain oversupplied for a long time. This is the reason why CGG took the decision to reduce drastically its exposure to this segment, downsizing its marine fleet to five vessels and at the same time dedicating 2/3 of the new fleet to multi-client programs.

CGG decided for cash optimization reasons to cold-stack its owned vessels and to continue operating its chartered vessels as we have an unconditional obligation to pay the charts. CGG had eight vessels in operation at end of December 2015 and plans to cold-stack three more vessels in Q1 2016. In Q2 2016, our remaining fleet will be made up of five chartered vessels. Once the leases come to an end, the owned vessels will gradually replace them, leading to stronger cash generation.

- Benefit of Cost Reductions

S&P states that “the related profit benefits (of CGG Transformation Plan) have yet to fully materialize”.

CGG points out that, following the implementation of its Transformation Plan launched as early as the end of 2013, it has already generated substantial cost reductions, since that time until September 2015, totaling (51)% of marine contractual costs, (55)% of G&A expenses and (46)% of Capex while 3,400 employees have already left the company.

In addition, and as announced on November 5th 2015, further cost reduction measures are being deployed in 2016 with, in particular, a project of an additional reduction of 930 positions worldwide. These measures are being implemented and are well on track.

- Value of CGG’s Assets

S&P states that “given the ongoing industry conditions, we do not believe a buyer would be available for the cold-stacked assets in the near term. As a result we have revised down our valuation of the group’s assets and hence updated recovery analysis of unsecured bonds”.

CGG would like to reiterate the point that the cold-stacked assets, which are mainly vessels, are already collateral to secured debt for the owned fleet. The value of such collateralized assets can hardly be directly linked to the recovery of unsecured bonds.

S&P’s states “CGG’s key business strengths include the company’s important global position and diversity”.

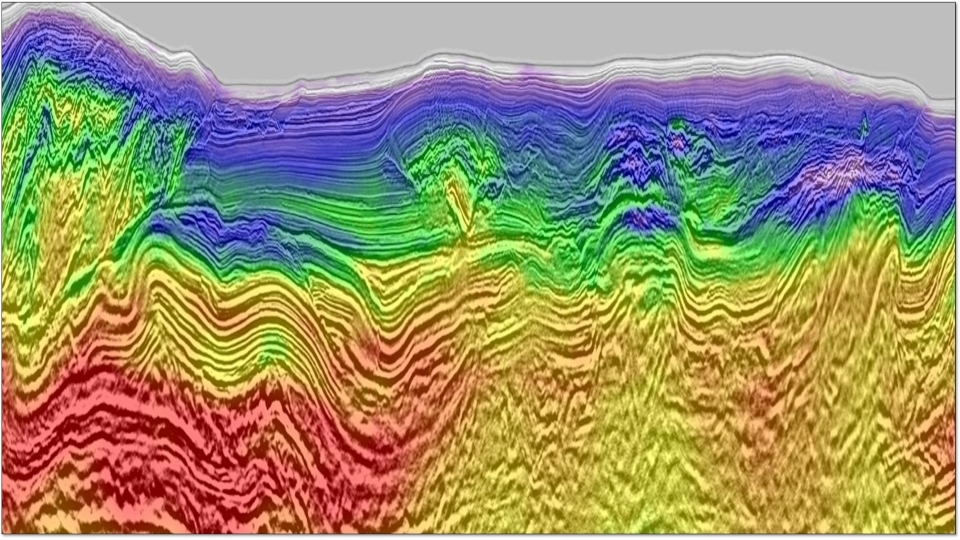

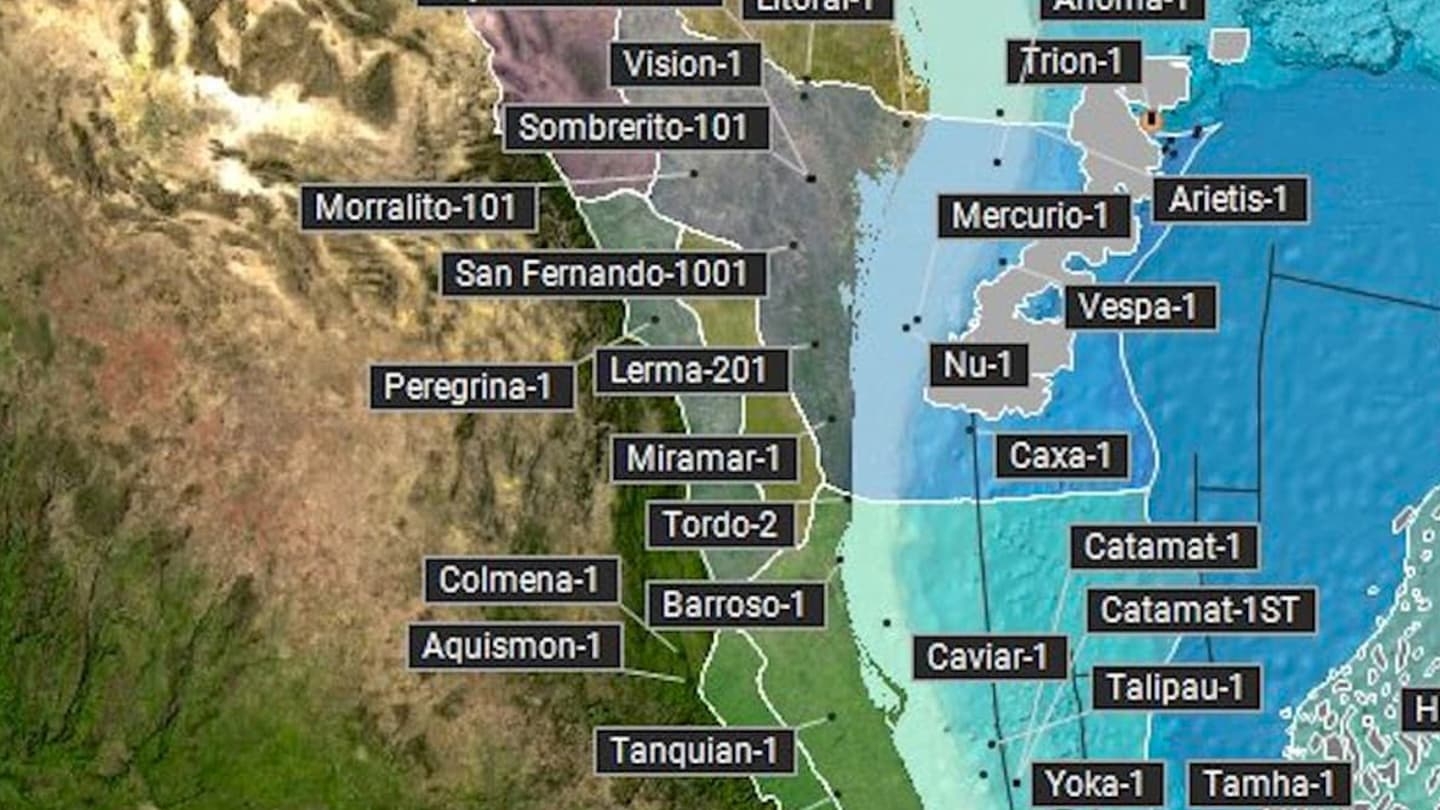

CGG would like to stress the value of the business relationship developed with our clients across the board and more specifically in Subsurface Imaging & Reservoir segment, and the value of our multi-client library, one of the Group’s top assets. With a net book value of $947m at the end of September 2015, our multi-client business delivered strong multi-client sales at $242m in Q4 2015 leading to total yearly sales of $545m, one of the best levels of multi-client sales in the industry in 2015.

2.New Financial, Capital and Cost Structure

- Debt Management

S&P refers to “the unsustainable capital structure” of the Group while also “recognizing CGG’s track-record of refinancing debts well ahead of maturities”

CGG wishes to emphasize that the Group managed to negotiate and extend the maturity of many instruments at very low cost for the company in a timely manner. We delivered the following actions in less than three months:

- November 2015: the public exchange offer on the 2017 HYB, against a new 2019 Secured Term Loan (at Libor + 5.5% interest weighted), with a 94% success rate, allowing only $8m Notes to be reimbursed in May 2017

- December 2015: the private exchange offer on the Fugro loan, with the same terms as for the transaction on the 2017 HYB

- December 2015: partial extension of the French RCF maturity, July 2016 instalment of $50m being 50% rolled-over to July 2017 and the July 2017 $275m instalment to June 2018.

As a consequence of these actions, the mandatory repayments due over the period 2015-2018 were reduced by $230m, leaving the company with financial debt repayment of $30m p.a. in 2016 and 2017 (not taking into account the capital leases). The overall senior debt maturity was extended to 4.5 years (excluding RCF) for an average interest rate at 5.45%.

- Capital Increase and Level of Liquidity

S&P refers to “the material improvement of CGG’s liquidity since November 2015, including through capital increase, which positively addresses one of the key concerns in previous base case”.

CGG agrees that Group’s liquidity has drastically improved. By the end of September 2015, CGG’s gross liquidity (including undrawn RCF) amounted to $440m:

- Thanks to a strong Q4 with high $242m multi-client sales demonstrating the quality of the multi-client library and tight cash management, CGG closed the Year 2015 with $385m in cash and a gross liquidity of $420m. Then,

- CGG raised €350m in a rights issue in early February 2016, increasing our cash by c.$370m, and driving the liquidity, in a pro forma basis, up to $790m as at end of December 2015.

We note however that S&P recognizes that CGG “could point to our adequate liquidity category, but we factor into our assessment of qualitative factors and reduced covenant leeway”.

- Covenants

S&P recognized “CGG’s track record of obtaining waivers”.

The Management took necessary actions and agreed the following with the Group’s three pools of banks (French, US, Nordic).

- CGG negotiated a full reset of covenants beyond the ‘covenant holiday’ obtained in November for December-End application

- The leverage ratio cap is now increased to 5.0x EBITDA throughout 2016, before reducing gradually down to 3.5x by December-2017.

- Capital Increase: Use of Proceeds

As a reminder, the purpose of the capital increase was to finance the company’s Transformation. The cash cost related to the different stages of the plan is of c.$200m in 2016 and c.$100m in 2017-2019.

CGG Q4 & Full year 2015 financial statements will be released on March 3rd 2015.