Back to Newsroom

CGG Provides End of 2015 Financial Update

Paris, France | Jan 11, 2016

Net Debt at $2.5B

Strong quarterly multi-client sales

New financial covenant sequence Extension of French revolver credit facility maturity

Balance Sheet Key Financial Figures

- CGG anticipates year-end 2015 net debt to be at $2,502m, to be compared to $2,538m by end of September 2015.

- The Group’s Liquidity, corresponding to the sum of the cash balance and the undrawn portion of the revolving credit facilities, is expected to amount to $420 million by December-end, to be compared to $440m by end of September 2015.

- Over the fourth quarter, the cash performance was notably sustained by strong multi-client revenue at $242 million, by Sercel sales at $102 million, and by a tight cost and working capital management.

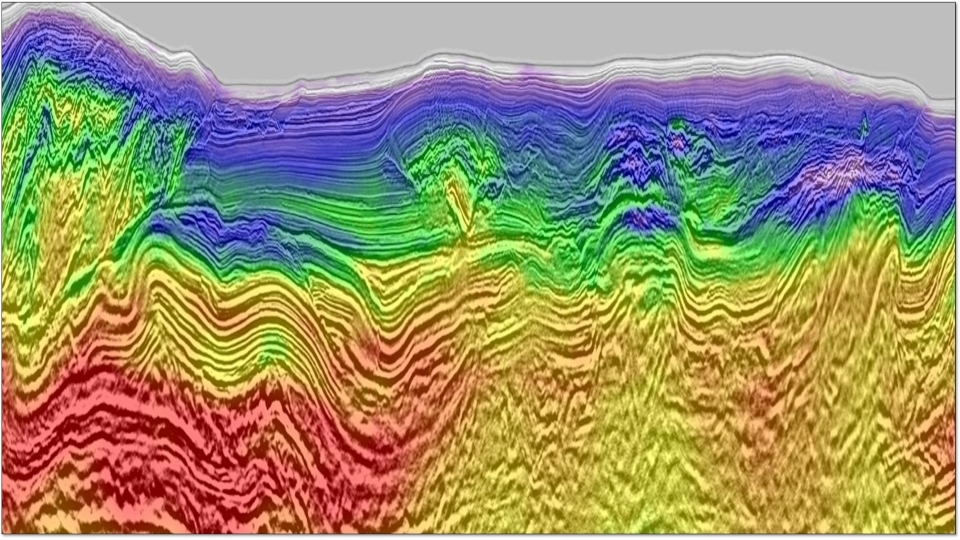

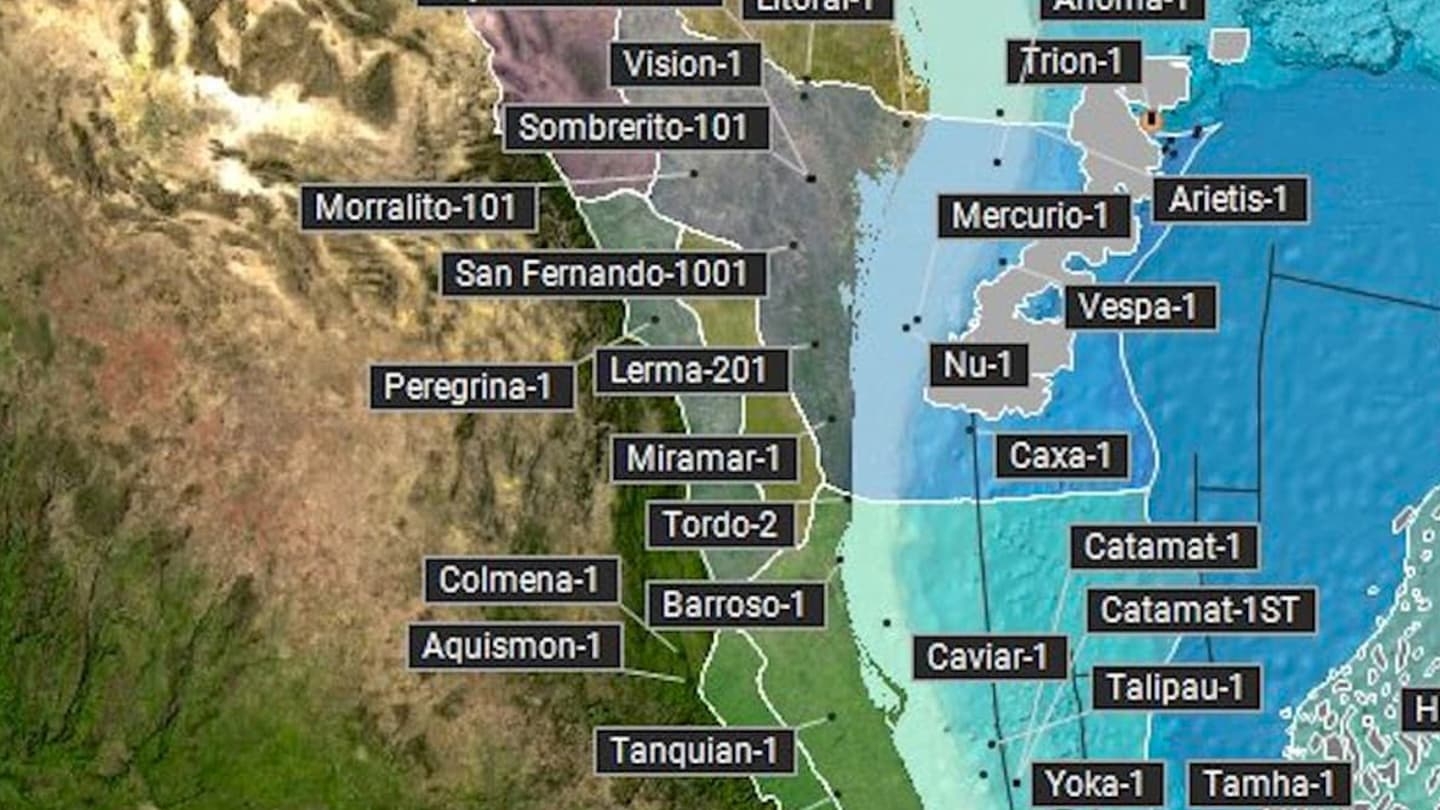

- Jean-Georges Malcor, CEO, CGG, said: “Our strong level of multi-client sales this quarter confirms our excellent technology and the unique strategic positioning of our multi-client library in key sedimentary geological basins.”

Financing

- CGG has negotiated with its main lending banks revised thresholds for its leverage covenant for 2016 and beyond, subject to the completion of the targeted €350 million capital increase. The maximum leverage ratio (defined as total net financial debt to EBITDA) would then be increased to a ratio of 5.00x for each rolling 12-month period ending in 2016, 4.75x for the rolling period ending in March 2017, 4.25x for the rolling period ending in June 2017, 4.00x for the rolling period ending in September 2017, 3.50x for the rolling period ending in December 2017, 3.25x for the rolling period ending in March 2018 and 3.00x thereafter.

- CGG has also agreed with its main lending banks a minimum liquidity covenant. In the case of its French and US revolving credit facilities, the group must maintain a minimum Group Liquidity amount (cash and cash equivalents plus undrawn revolving credit facilities) of $175 million at each quarter end. In the case of its Nordic facility, the group must maintain a minimum liquidity amount (cash and cash equivalents) of $100 million at all times.

- Last, CGG and its French RCF lenders have agreed upon an amendment of its $325 million revolving facility agreement leading, subject to the completion of the targeted €350 million capital increase, to a new scheduling of the total commitments of the lenders thereunder: $325 million up to July 2016, $300 million up to July 2017 (instead of $275 million) and $275 million up to June 2018. This extension of the maturity of the French RCF completes the Q4 2015 refinancing plan of CGG with the execution in December of a Secured 2019 Term Loan to replace 94%of the oustanding 2017 High Yield Bonds and 100% of the Fugro Vendor Loan.

Other Information

Vessel utilization rates

- The vessel availability rate in Q4 2015 was 92%. This compares to a 87% availability rate in the fourth quarter of 2014 and a 84% rate in the third quarter of 2015.

- The vessel production rate in Q4 2015 was 89%. This compares to a 92% production rate in the fourth quarter of 2014 and a 92% rate in the third quarter of 2015.

- During the quarter, our vessels were allocated 73% to contract and 27% to multi-client.

Availability of a Form 6-K

CGG has published a report on Form 6-K updating its 2014 annual report on Form 20-F, which is available on the Company’s website and on the website of the SEC (www.sec.gov).