CGG Announces its Q4 & FY 2023 Results

Paris, France | Mar 6, 2024

Strong Financial Improvements in 2023:

Revenue at $1,125m, up 21%

Organic cash generation of $32m*

Positive net cash generation in 2024 and around $100m in 2025 to support the deleveraging roadmap

CGG (ISIN: FR0013181864), a global technology and high-performance computing leader announced today its fourth quarter and full year 2023 audited results.

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:

“In 2023, CGG significantly strengthened its financial performance, and I am pleased to see that we returned to positive organic cash flow generation, while continuing to invest in our New Businesses.

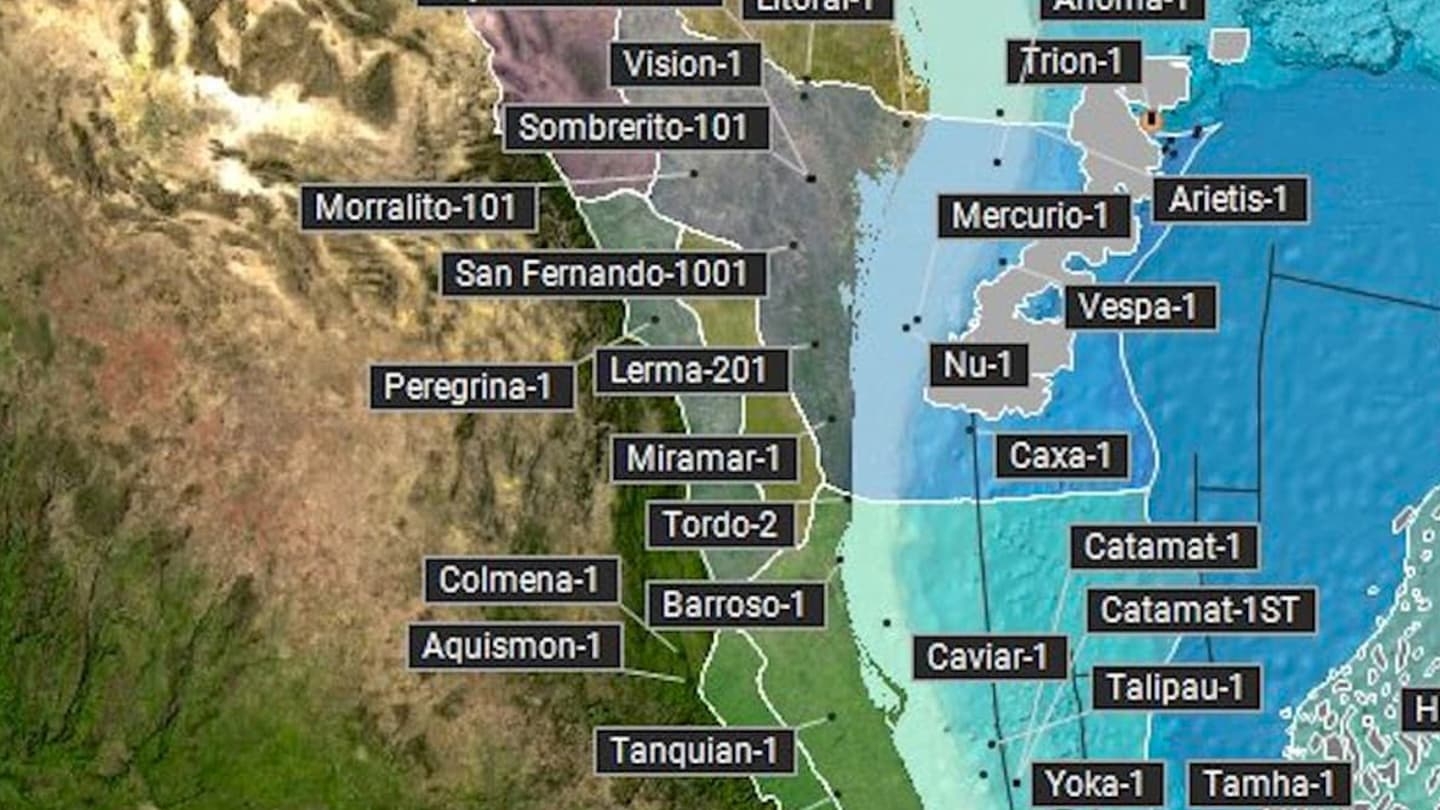

CGG today not only remains the clear leader in its core businesses, it also addresses the Energy Transition as well as the new technology-enabled markets of High-Performance Computing and Infrastructure Monitoring.

After a good start in early 2024, we will continue to develop the company with a focus on further strengthening our core businesses, accelerating the growth of our New Businesses, and delivering our financial roadmap that prioritizes cash generation and balance sheet deleveraging.”

* including $(66)m fees from contractual vessel commitments

Q4 2023: A strong cash generation of $48m

IFRS figures: revenue at $265m, EBITDAs at $68m, OPINC at $(11)m.

Segment revenue at $320m, flat year-on-year.

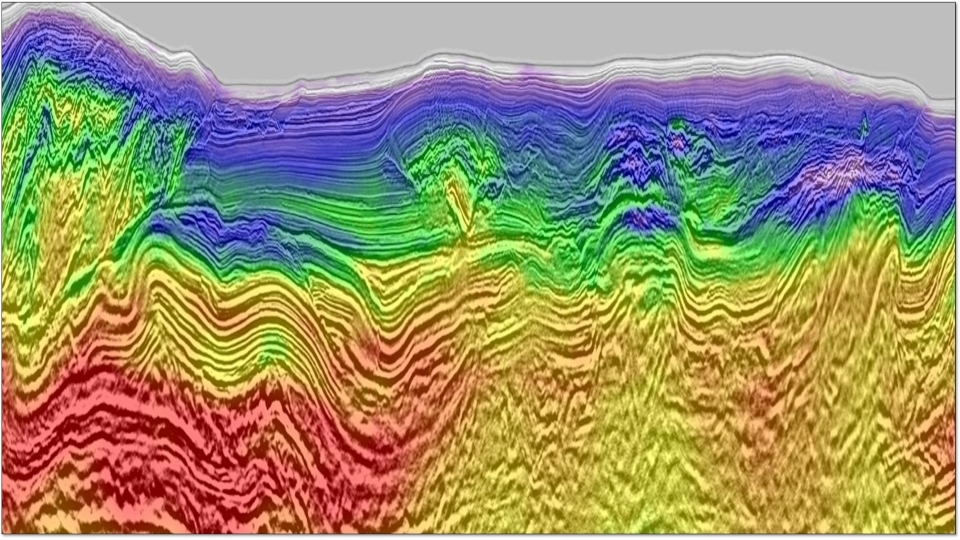

- Geoscience at $98m, up 41% year-on-year.

- Earth Data at $103m, down (29)% year-on-year. Prefunding revenue at $62m, down (8)% year-on-year. After sales at $41m, down (47)% year-on-year.

- Sensing & Monitoring at $119m, up 14% year-on-year.

Segment EBITDAs at $122m, a 38% margin, including $(13)m fees from contractual vessel commitments and $(8)m old equipment inventory write-off.

Segment operating income at $15m, a 5% margin.

Group net income at $(15)m.

Net cash-flow at $48m, including $(18)m fees from contractual vessel commitments.

Full year 2023: Strong financial improvement

IFRS figures: revenue at $1,076m, EBITDAs at $351m, OPINC at $119m.

Segment revenue at $1,125m, up 21% year-on-year.

Segment EBITDAs at $400m, a 36% margin due to business mix as well as $(44)m fees from contractual vessel commitments and a $(8)m SMO inventory write-off.

Segment operating income at $138m, a 12% margin due to business mix.

Group net income at $16m.

Net cash flow at $32m, including $(66)m fees from contractual vessel commitments.

More:

Q4 2023 Conference call

- The press release and the presentation will be made available on our website www.cgg.com at 5:40 pm (CET)

- An English language analysts conference call is scheduled the same day at 6.00 pm (CET)

Participants should register for the call here to receive a dial-in number and code or participate in the live webcast from here.

A replay of the conference call will be made available the day after for a period of 12 months in audio format on the Company's website www.cgg.com.

About CGG

CGG (www.cgg.com) is a global technology and HPC leader that provides data, products, services and solutions in Earth science, data science, sensing and monitoring. Our unique portfolio supports our clients in efficiently and responsibly solving complex digital, energy transition, natural resource, environmental, and infrastructure challenges for a more sustainable future. CGG employs around 3,400 people worldwide and is listed on the Euronext Paris SA (ISIN: 0013181864).