2016 Second Quarter Results

Paris, France | Jul 29, 2016

Market conditions remain challenging; second-quarter results driven by sustained GGR performance

- Strong Execution of Operations and of our Transformation Plan

- Revenue down to $290m due to the fleet reduction and weak market conditions

- GGR: good level of multi-client sales with high 84% cash prefunding rate

- Equipment: strongly impacted by very low volumes

- Contractual Data Acquisition: lower revenue due to fleet reduction and 66% fleet allocation to multi-client programs, as targeted

- Solid EBITDAs1 at $104m

- Operating Income1 at $(22)m

Positive cash generation in H1

- H1 Free Cash Flow at $8m after Non-Recurring Charges (NRC), versus $(130)m last year, and at $97m before NRC

- Net debt at $2,150m at end of June, corresponding to a 3.9x leverage ratio

Full Year 2016

- c. 75% of fleet capacity dedicated to Multi-Client in Q3 and c. 35% in Q4

- $50m additional cut in Capex: Multi–client cash capex at $300/350m with a cash prefunding rate above 70%; industrial capex at $75m/100m

- Confirmation of a year-end net debt target below $2.4bn

1 - Figures before Non-Recurring Charges (NRC) related to the Transformation Plan

PARIS, France – July 29th 2016 – CGG (ISIN: FR0013181864 – NYSE: CGG), world leader in Geoscience, announced today its non-audited 2016 second quarter results.

Commenting on these results, Jean-Georges Malcor, CGG CEO, said:

“With the rise in crude oil prices during the first few months of the year, we can see early signs of a change in the sentiment of our clients, but this has not, for the time being, led to a recovery in exploration spending, which is still at a very low level. Within this context, the Group remains focused on its priorities of strong operational performance, delivering its Transformation Plan, tightly controlling costs and stringent cash management.

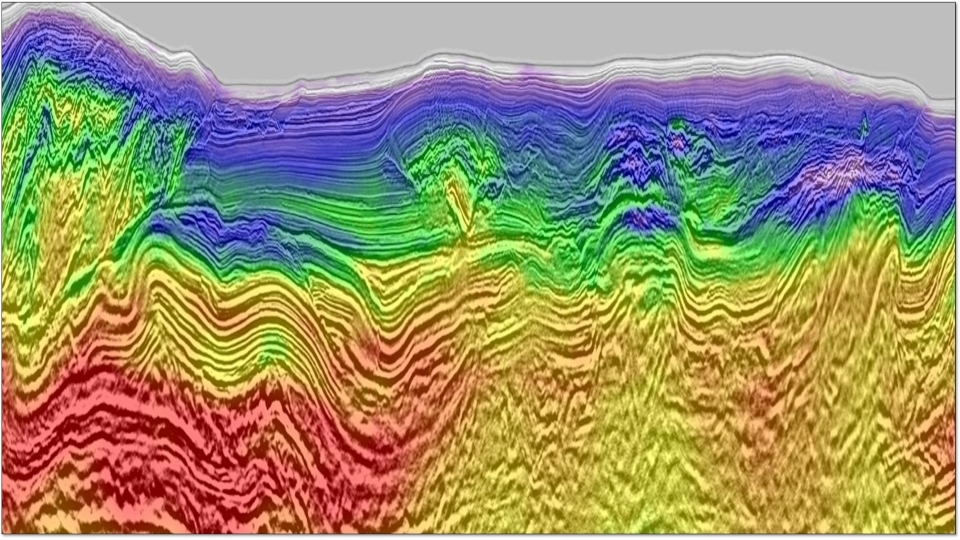

During this quarter, GGR has seen a satisfactory level of activity with multi-client sales boosted by a high prefunding rate, and a good performance by Subsurface Imaging & Reservoir (SIR). Our Equipment activity continued to be strongly impacted by very low volumes. As announced in our Plan, the contribution from our Contractual Data Acquisition activity is decreasing, with our marine fleet being mainly focused on multi-client programs.

By right-sizing and successfully implementing our Transformation Plan, strictly managing our costs and our cash, we have been able to deliver positive free cash flow over the full half-year, after non-recurring charges relating to the Transformation Plan. In a still uncertain market environment, we plan to continue optimizing our external costs base and to reduce our annual capital expenditure by an additional 50 million dollars. We confirm our aim of net debt below 2.4 billion dollars by the end of 2016.”

Post-Closing Event

The Company carried out on July 20 the reverse stock split that the combined general shareholders’ meeting approved on May 27. All shareholders did receive one new share and all rights pertaining to shares, in exchange for 32 former shares. The first share price on July 20 was calculated on the basis of the last share price traded on July 19 (€0.69) multiplied by 32.

*For full financial records, please reference the Investors section of this website.*