2016 Third Quarter Results

Paris, France | Nov 8, 2016

Persistently difficult market conditions

Third quarter Revenue down to $264m

-

- GGR: resilient with solid multi-client prefunding, leading to an 88% year-to-date cash prefunding rate

- Equipment: still impacted by low external volumes

- Contractual Data Acquisition: low revenue due to weaker land activity and high fleet allocation to Multi-Client programs

- EBITDAs1 at $97m

- Operating Income1 at $(39)m

Strict focus on costs, cash and liquidity management

- Good execution of our Transformation Plan with a strong reduction in our cost base across the Group

- Solid operational performance with a 94% marine production rate

- Ongoing discussions with shipowners to reduce charter costs

- Year-to-date Free Cash Flow at $(9)m before Non-Recurring Charges (NRC) and at $(142)m after NRC

- Net debt at $2,304m at end of September, corresponding to a 4.4x leverage ratio and $604m liquidity

Year-end outlook

- Fleet coverage: 95% in Q4 2016, including 40% dedicated to Multi-Client, and 80% in Q1 2017, including c.30% dedicated to Multi-Client

- Full-year Multi-Client sales highly dependent on Q4 after-sales, while FY cash prefunding rate now expected to be above 80% (versus 70% target)

- Year-end net debt target confirmed below $2.4bn

1 - Figures before Non-Recurring Charges (NRC) related to the Transformation Plan

PARIS, France – November 8th 2016 – CGG (ISIN: FR0013181864 – NYSE: CGG), world leader in Geoscience, announced today its non-audited 2016 third quarter results.

Commenting on these results, Jean-Georges Malcor, CGG CEO, said:

"The context of rising crude prices did not yet translate for our industry in improved market conditions which remain difficult. This environment has impacted our third quarter revenues, while our fourth quarter remains highly dependent on seasonal Multi-Client activity and more specifically on the level of after-sales.

In this context, we remain fully focused on strict cost and cash management and on preserving our liquidity. We have rigorously delivered good operational performance with the successful execution of both our contracts and Transformation Plan, while preserving our industrial capabilities and technological expertise. We confirm our target of a net debt below $2.4 billion at year-end 2016.

While at the beginning of 2016 we targeted an improvement in certain of our activities for 2017, and as our customers are still in their budget planning process, our latest discussions suggest that our 2017 market should remain very similar to 2016. In light of this situation and based on our Q4 performance, we will take steps to evaluate our short- and long-term alternatives to address our capital structure constraints.

With our technology leading positions, expertise and the commitment of our employees, our group is well positioned to offer integrated geoscience solutions best suited to meet the new demands of our customers."

Post-Closing Events

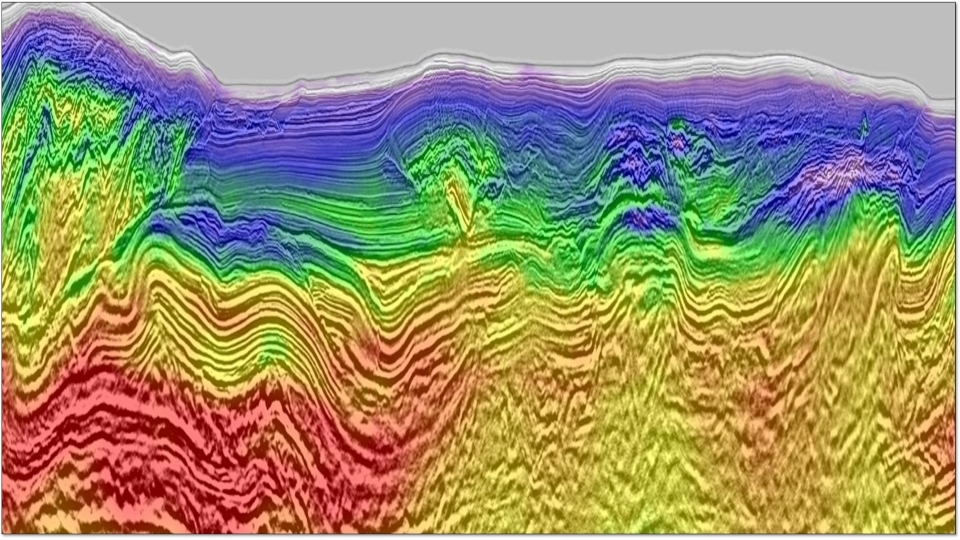

- On October 13th, CGG was awarded an extensive multi-client program by the Instituto Nacional de Petroleo (INP) to acquire seismic data offshore Mozambique. The program includes a large 3D survey that is expected to be up to 40,000 km², subject to pre-commitment, and a 2D survey of over 6,550 km. This program fits well with CGG’s long-term multi-client strategy to provide our clients with the most advanced understanding of the subsurface across the world’s key basins.

- On October 25th, CGG was awarded a major contract by Pemex to deliver a wide-azimuth integrated solution in the geologically complex deep waters of the Perdido area offshore Mexico. The new survey covers approximately 10,000 km2, and will commence early 2017, with full processing results delivered in 2018.

*For full financial records, please reference the Investors section of this website.*