2017 First Quarter Results

Paris, France | May 12, 2017

Year-on-year stable EBITDA in a traditionally low seasonal quarter

- Revenue at $249m

- GGR: resilient multi-client quarterly performance in traditional low season

- Equipment: particularly low volumes

- Contractual Data Acquisition: down due to perimeter effect

- EBITDAs1 at $29m

- Group Operating Income1 at $(67)m

- Capex at $68m and Free Cash Flow1 at $(74)m as expected given low positive working capital effect of $13m

- Net income at $(145)m

Balance Sheet: proactive debt management

- Maritime liabilities: four settlement agreements that led to a very substantial reduction of the charter obligations and the issue of c. $71m 2021 Senior Notes

- By end of Q1, $182.5m Nordic loan recorded as non-financial liability in the context of the creation of Global Seismic Shipping AS JV

- Net debt at $2,335m at end of March and $391m liquidity

Financial restructuring: dedicated communication

- Mandataire ad hoc appointed on February 27th

- Maintenance covenants disapplied at quarter-end

- Dedicated “Business update and financial restructuring presentation” released today

1Figures before Non-Recurring Charges related to the Transformation Plan and data library impairment

Paris, France – 12 May 2017 - CGG (ISIN: FR0013181864 – NYSE: CGG), world leader in Geoscience, announced today its 2017 first quarter unaudited results.

Commenting on these results, Jean-Georges Malcor, CGG CEO, said:

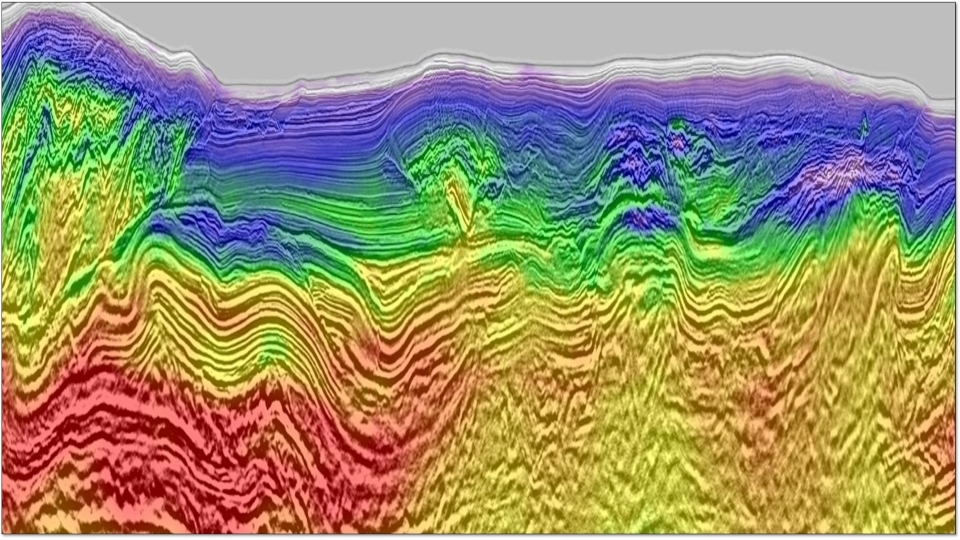

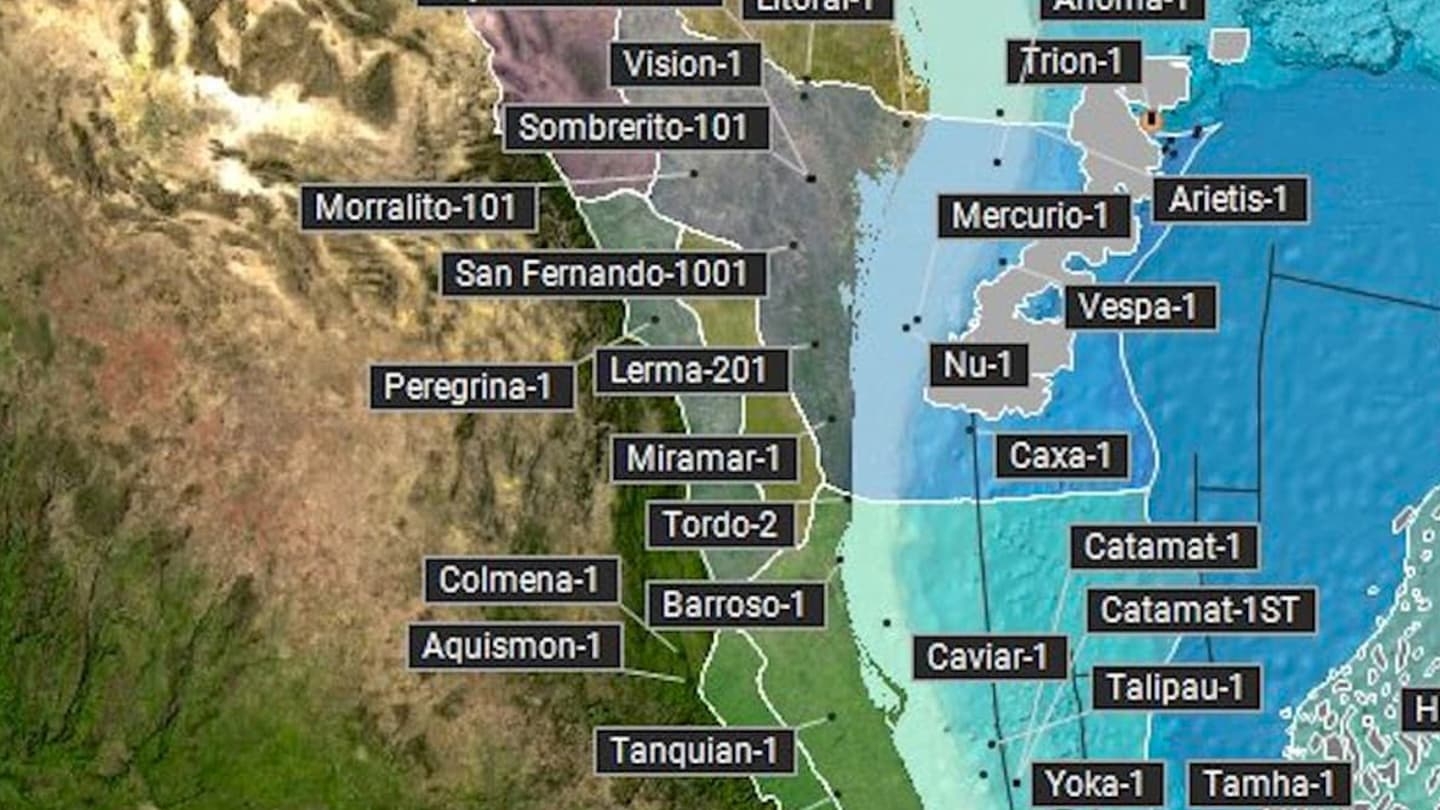

“As indicated in March, we entered into an intense phase of our financial restructuring process. There is a separate communication on the status of negotiations today. Now focusing on operational matters, the stable first quarter EBITDA is an encouraging result in a still competitive market environment. Equipment sales dropped to a particularly low level, while GGR delivered a stable activity with multi-client revenue of $72 million driven by a high cash prefunding rate at 110%. In a continued low but stabilized pricing environment, the marine production rate reached a record level of 98%.

As expected, cash flow generation was hampered by the very weak positive working capital effect compared to the first quarter of 2016. The Group nevertheless benefited from nearly $400 million of liquidity at the end of March.

Alongside the financial restructuring, all our teams remain fully focused on further optimizing our cost structure, while delivering the best technical and operational solutions to our clients. We confirm for 2017 our vision of operating results in line with 2016 with downward pressure on cash flow generation.”

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).