CGG Announces Issuance of $300 million and €280 million First Lien Senior Secured Notes

Paris, France | Apr 24, 2018

CGG S.A. announces today the issuance by its wholly-owned indirect subsidiary, CGG Holding (U.S.) Inc., of $300 million in aggregate principal amount of 9.000% First Lien Senior Secured Notes due 2023 and €280 million in aggregate principal amount of 7.875% First Lien Senior Secured Notes due 2023 (together, the “Notes”).

The issuance of the Notes was a condition to the redemption of the Existing First Lien Notes. That condition has now been fulfilled, and the Existing First Lien Notes will be redeemed on May 6, 2018. Because the redemption date is not a Business Day (as such term is defined in the indenture governing the Existing First Lien Notes), the redemption price of, and accrued interest on, the Existing First Lien Notes will be paid to the holders thereof on May 9, 2018, the next succeeding Business Day following the redemption date.

The net proceeds from the issuance have been irrevocably deposited in trust with The Bank of New York Mellon, London Branch, together with cash on hand, to satisfy and discharge the indenture governing the existing $664 million First Lien Senior Secured Notes due 2023, issued on February 21, 2018 (the “Existing First Lien Notes”).

About CGG

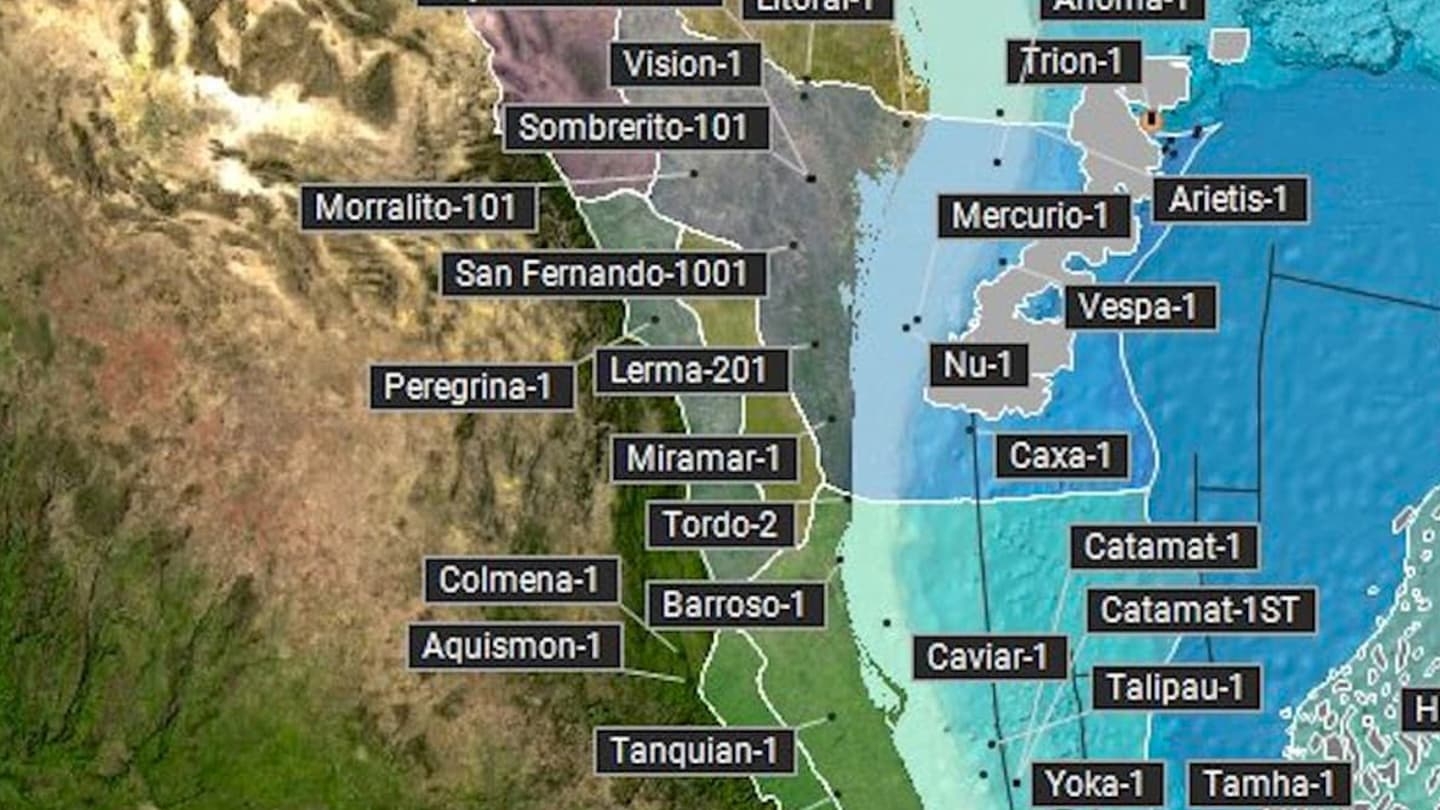

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).