CGG Announces its 2017 Fourth Quarter Results & Full-Year Results

Paris, France | Mar 9, 2018

CGG (ISIN: FR0013181864 – NYSE: CGG), world leader in Geoscience, announced today its 2017 fourth quarter and full-year unaudited results.

2017 Q4: Rebound in Revenue and Positive Operating Income

- Revenue at $401m, up 22% year-on- year

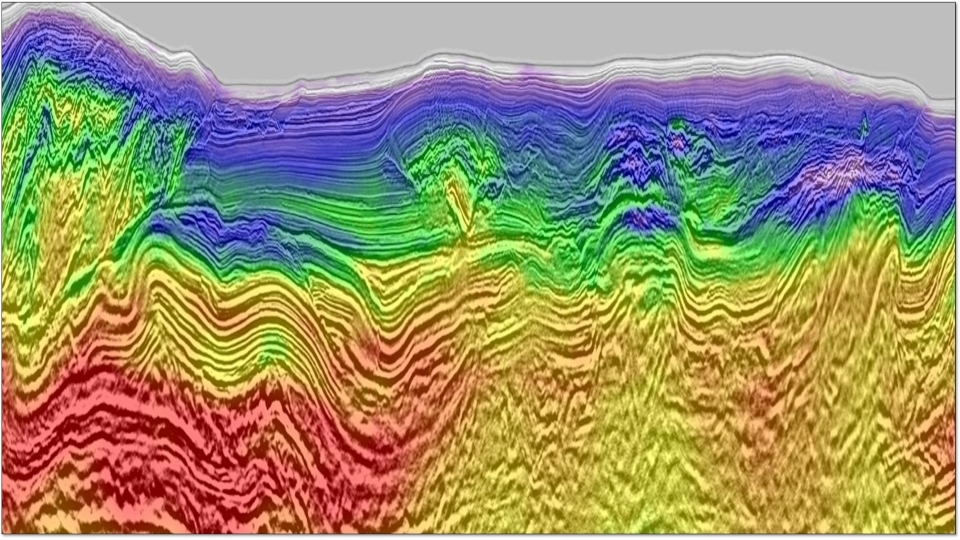

- GGR: strong Multi-Client sales in Brazil and North Sea

- Equipment: very strong volume recovery

- Contractual Data Acquisition: low Marine revenue as 75% of fleet dedicated to multi-client surveys

- EBITDAs1 at $134m, up 34% year-on-year, 33% margin

- Group Operating Income1positive at $18m versus $(70)m in Q4 2016

- Free Cash Flow at $13m

FY 2017: Improved Revenue and EBITDAs

- Revenue at $1,320m, up 10% year-on-year

- GGR: strong Multi-Client sales, resilient SIR performance

- Equipment: higher external volumes

- Contractual Data Acquisition: driven by two large contracts with high-end multi-source vessel setup

- EBITDAs1 at $372m, up 14% year-on-year, 28% margin

- Group Operating Income1 at $(77)m versus $(213)m in 2016

- Multi-client cash capex at $251m, 107% prefunded

- Industrial and R&D capex at $84m and Free Cash Flow1 at $(96)m

- Net debt at $2,640m at end of December with liquidity at $315m

- Net income at $(514)m including $(186)m non-recurring charges

Financial Restructuring Plan Fully Implemented

- Sanctioning of the safeguard plan by the French commercial court on December 1, 2017 and emergence from Chapter 11 in the US on February 21, 2018

- Full success of the January 2018 €112m Rights issue

- All new instruments delivered on February 21, 2018:

- Shares: 578.6 million shares outstanding prior warrants exercise

- Bonds: $664m 2023 1st lien High Yield Bonds; $355m & €80m 2024 2nd lien HYB

- Restored capital structure with pro forma net debt of $631m(2), liquidity of $575m and leverage ratio at 1.7x

2018 Outlook

- Revenue3 expected up at c. $1.5bn +/- 5% in a stabilized and still uncertain market

- EBITDAs1-3 margin within 35% to 40% range

- Multi-Client cash capex at $275/325m with cash prefunding rate above 70%

- Industrial and R&D capex at $100/135m

- Cash cost of debt at c. $85m

- Industrial Transformation Plan cash cost at c. $25m

1Figures before Non-Recurring Charges related to the Transformation Plan and data library impairment

2 Including c. $50m of financial restructuring costs to be paid in Q1 2018

3 Subject to final IFRS 15 application

Commenting on these results, Jean-Georges Malcor, CGG CEO, said:"In a still challenging market overall, the Group achieved a robust 22% growth in fourth quarter revenue year-on-year, thanks, in particular, to a high level of land equipment sales and the good positioning of our multi-client data library in the strategic basins offshore Brazil and the North Sea. This level of revenue led to positive quarterly operating income for the first time in eight quarters.

After a decline in earnings over the last three years, we recorded a 10% increase in revenue and a 14% growth in EBITDA for the full year 2017, demonstrating the effectiveness and success of our industrial Transformation Plan, particularly the sharp reduction in our cost base.

Following the approval of the safeguard plan in France and the exit from Chapter 11 in the United States at the end of February, our financial restructuring is now finalized. At the closing of the financial restructuring and on a pro forma basis, CGG has a restored balance sheet with a net debt brought back to $631m, corresponding to a leverage ratio at 1.7 times.

Throughout this difficult period, CGG benefited from the continuous support of its clients and the full commitment of its employees and is now ready for a new momentum. With a restored balance sheet, strong technological positions and proven operational excellence, the Group has begun 2018 with renewed confidence and is ready to take full advantage of a rebound in the market."

Post-closing events

- January 15th: Reduction of the share capital from €17,706,519 to €221,331 by reducing the nominal value of the Company’s shares from €0.80 to €0.01

- January 22nd: Launch of the capital increase with preferential subscription rights for an amount of €112 million, by way of an issuance of shares of the Company each with one warrant attached (Warrants #2)

- January 25th: Trading halt on the Convertible Bonds 2019, the Convertible Bonds 2020, and the Senior Notes on the Euro MTF market, from the opening of the market on February 1, 2018

- February 9th: Rights issue with preferential subscription right (PSR) of €112 million (including share premium) was fully subscribed

- February 21st: Completion of the financial restructuring with settlement-delivery of all securities and instruments.

The financial restructuring with settlement-delivery of all securities and instruments will result in a c. $0.75 billion gain in our consolidated statement of operations. In addition, the equity will increase by c. $1.3 billion through the issuance of new shares (coming from the equitization of the unsecured debt, the rights issue and the future exercise of warrants #3, coordination warrants and backstop warrants), to reach a total equity increase of c. $2.05 billion. Emergence from Chapter 11 for the fourteen guarantor subsidiaries the very same day

*For full financial records, please reference the Investors section of this website.*

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).