CGG Announces its 2018 Second Quarter Results

Paris, France | Aug 2, 2018

CGG (ISIN: FR0013181864 – NYSE: CGG), world leader in Geoscience, announced today its 2018 second quarter unaudited results.

2018 Q2: Strengthened Segment EBITDAs Margin in Gradual Market Improvement

- IFRS figures1: revenue at $314m, OPINC at $26m, net income at $49m

- Segment revenue2 at $338m, down 3% year-on-year

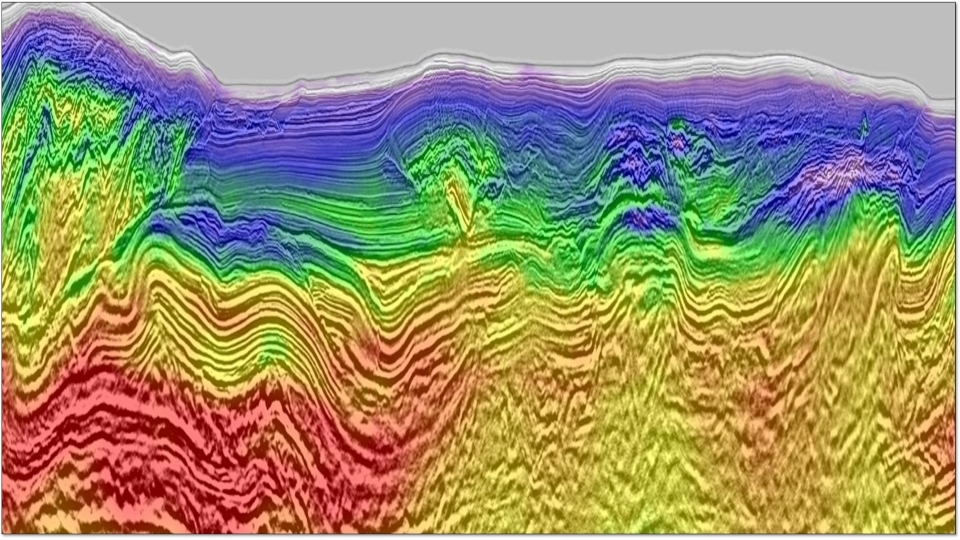

- GGR: robust Subsurface Imaging & Reservoir (SIR) activity and Multi-Client driven by high after-sales partly offsetting lower prefunding

- Equipment: strong volume increase leading to breakeven

- Contractual Data Acquisition: continuing competitive market environment

- Segment EBITDAs2 at $110m, down 9% year-on-year, a 33% margin

- Segment operating income2 at $40m versus $(3)m last year, supported by favorable Multi-Client sales mix and increase in Equipment sales

Q2 Operational Highlights

- Multi-Client recorded large sales in North Sea and US onshore; activity in Brazil, Mozambique and Permian basin

- SIR activity driven by client reservoir/ production imaging and services, including nodes processing

- Equipment main sales notably in North Africa and Asia

- Contractual Data Acquisition fleet operating in West Africa

H1 2018: Activity Gradually Improving

- IFRS figures1: revenue at $560m, OPINC at $(41)m, net income at $696m

- Segment revenue2 at $633m, up 6% year-on-year

- Segment EBITDAs2 at $163m, up 9% year-on-year, a 26% margin

- Segment operating income2 at $17m, versus $(71)m last year

Sound Financial Situation

- First Lien refinancing completed in April 2018

- Limited cash consumption, segment FCF at $(9)m

- Net debt of $716m at end of June, liquidity of $447m and leverage ratio at 1.9x

Reiterated 2018 Outlook

- Capital Market Day planned on November 7th

1Based on transitory IFRS 15 application

2Segment figures presented before IFRS 15 and Non-Recurring Charges (NRC)

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:“The second quarter results were in line with our expectations with a stable EBITDAs margin year-over-year. SIR performed well and Multi-Client after-sales were particularly high with significant contribution from the North Sea. Prefunding was low, primarily as a result of regulatory delays. Equipment saw strong volume increase and returned to breakeven. Contractual Data Acquisition activities were still under pressure with continued low prices.

Priority is to focus on cash generation, and specifically this quarter cash consumption was limited due to rigorous management of working capital.

In the context of a gradual market improvement, while clients maintain a cautious approach to spending, we remain on track to meet our targets for 2018.”

Post-closing events

- Geowave Voyager

SeaBird Exploration Plc announced on July 11, 2018 that it was in an exclusive process to acquire our seismic vessel Geowave Voyager and certain seismic equipment for cash consideration of US$17 million. The transfer of ownership of the Vessel and closing of the transaction is expected to be finalized by October 2018. As of June 30, 2018, the classification of the Geowave Voyager as an asset held for sale is unchanged.

- Convertible Bondholder’s Appeal

On July 17, 2018, certain holders of CGG’s convertible bonds filed a recourse before the French Supreme Court (Cour de cassation) against the ruling rendered on May 17, 2018 by the Appeals Court of Paris rejecting a claim by a group of Convertible Bondholders against the ruling of the Commercial Court of Paris sanctioning the safeguard plan on December 1, 2017.

Transitory first time application of IFRS 15

Discussions between CGG, its auditors and the regulators are still on going. CGG continues advocating for the IFRS 15 compliance of revenue recognition policy based on the two distinct performance obligations contained in these contracts.

In the absence of a finalized IFRS 15 accounting policy, prior to the Group’s second quarter 2018 results, CGG decided to continue presenting a dual approach:

(i) one set of figures (the “IFRS” figures) in line with the accounting practice adopted by some other seismic players, with pre-commitment revenue recognized in full only upon delivery of the final data, and

(ii) a second set of figures (the “Segment Figures”) corresponding to the figures used for internal management reporting purposes and produced in accordance with the Group’s historical method (percentage of completion for multi-clients pre-commitments).

The Company aims to fix a definitive approach with its auditors and the regulators ideally prior to the release of Q3 2018 financial statements and at the latest for the 2018 annual report.

Please find below tables for key IFRS figures, segment figures and bridges; please refer to our 6-K document for full IFRS financial statements.

*For full financial records, please reference the Investors section of this website.*

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).