CGG Announces its 2018 Third Quarter Results

Paris, France | Nov 7, 2018

CGG (ISIN: FR0013181864), world leader in Geoscience, announced today its 2018 third quarter unaudited results.

Q3 2018: Strong Equipment Growth

- IFRS figures1: revenue at $439m, OPINC at $45m, net income at $(2)m

- Segment revenue2 at $333m, up 4% year-on-year

- Segment EBITDAs2 at $109m, up 22% year-on-year, a 33% margin

- Segment operating income2 at $40m, versus $(24)m last year, a 12% margin

Q3 Operational Highlights

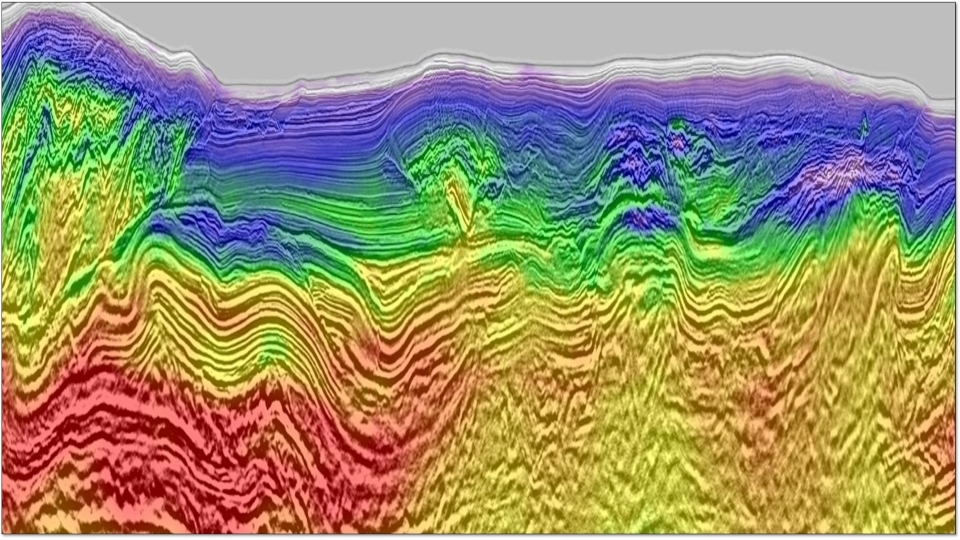

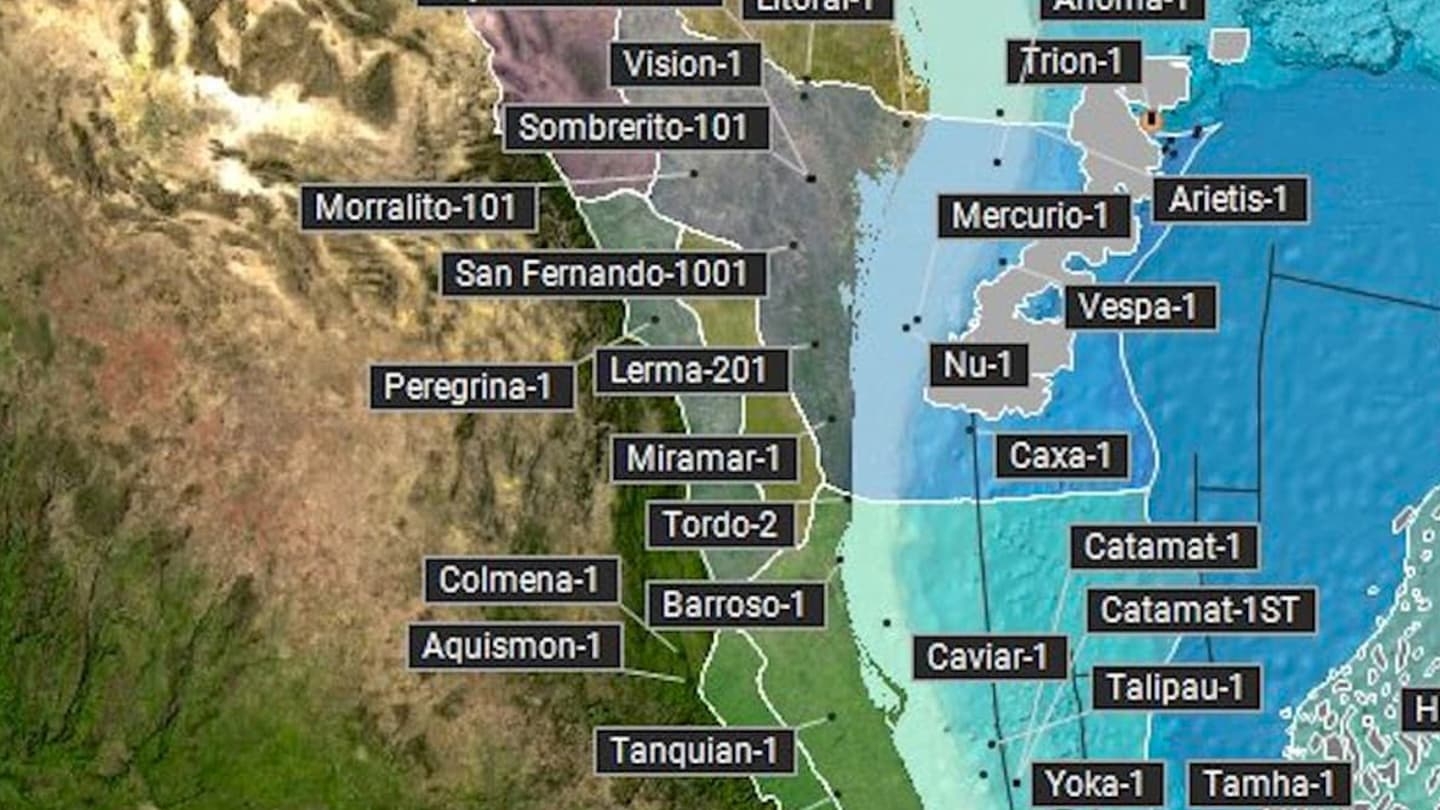

- Geoscience (SIR): robust demand for advanced imaging dedicated to reservoir delineation and production

- Multi-Client: high level of after-sales in active basins but lower prefunding with c. $25m delayed to October

- Equipment: demand for land picking up strongly in Middle East and Asia

- Contractual Data Acquisition: solid fleet availability rate at 93% in continued difficult market

Sound Financial Situation

- Good cash management with segment FCF at $(17)m

- Net debt of $769m at end of September, liquidity of $412m and leverage ratio at 1.9x

1Based on transitory IFRS 15 application

2Segment figures presented before IFRS 15 and Non-Recurring Charges (NRC)

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:“Our third quarter revenue was up 4% year-on-year, confirming the gradual market recovery. Geoscience saw robust performance and Multi-Client delivered a high level of after-sales but was impacted by delayed pre-funding recognized in October. Equipment sales increased significantly for land achieving double digit operating income margin. Acquisition continues to suffer from low prices in a commoditized market.

In that context, we remain on track with our 2018 targets based on sizeable year-end Multi-Client opportunities and strong Equipment deliveries.”

Transitory application of IFRS 15

CGG implemented IFRS 15 on January 1, 2018 with a modified retrospective application. The only change compared to Group historical practices is related to multi-clients prefunding revenues. These prefunding revenues are recorded at delivery of the final data while they were historically recorded based on percentage of completion.

CGG, as other seismic players, presents then a dual approach in the Group’s results including:

(i) one set of figures (the “IFRS” figures) with pre-commitment revenue recognized in full only upon delivery of the final data and

(ii) a second set of figures (the “Segment figures”) produced in accordance with the Group’s historical method, which correspond to the figures used for internal management reporting purposes and provide comparative information during the year 2018.

*For full financial records, please reference the Investors section of this website.*

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).