CGG Announces its 2020 First Quarter Results

Paris, France | May 12, 2020

Solid First Quarter

Adjusting to an Unprecedented Crisis

CGG (ISIN: FR0013181864), a world leader in Geoscience, announced today its 2020 First Quarter unaudited results.

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:“As we are navigating through this unprecedented industry crisis, created by the combined results of oversupply and reduction in demand due to the COVID-19 pandemic, our priority remains on the health and safety of our employees and all our stakeholders, along with the continuity of our business to meet our clients’ needs. With our new asset light business profile, and our business segments positioned around reservoir evaluation and production optimization, including our data library, which is focused on proven or mature sedimentary basins, we expect CGG to be much more resilient than in the past. While the duration of this severe crisis is uncertain, we are focusing on what we can control: managing our liquidity, implementing the required capex and cash cost reductions and adjusting the organization as necessary while maintaining our R&D efforts. With $624m of cash on hand after a solid Q1 and no bond debt to reimburse before April 2023, I am confident that our asset light strategy based on high-end technology, services, data and products positions us the best for these challenging market conditions."

Q1 2020 Positive cash generation

IFRS figures: revenue at $253m, OPINC at $(40)m

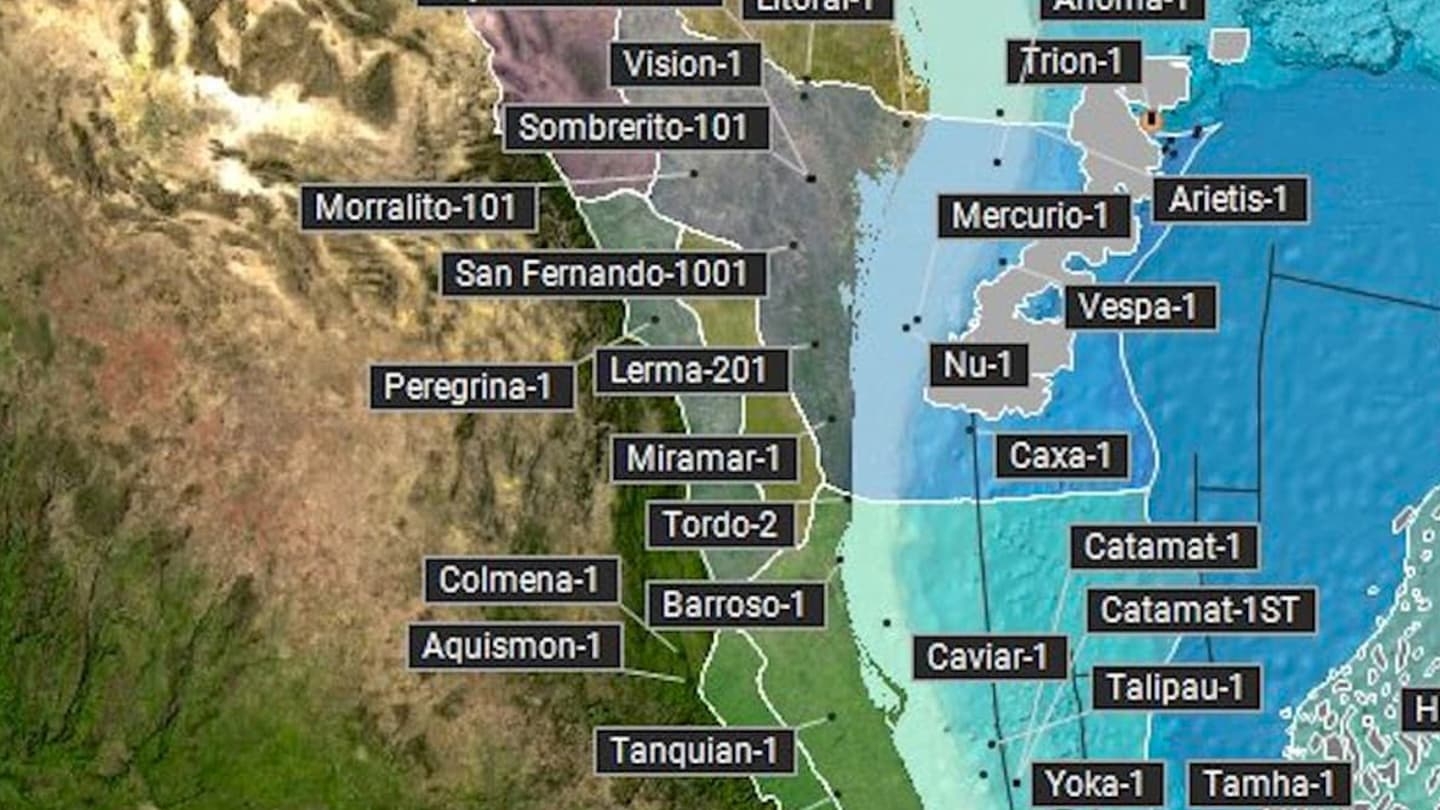

Segment revenue at $271m, down 4% year-on-year, with solid multi-client revenue and lower equipment sales

Segment EBITDAs at $123m, up 3% year-on-year, a 45% margin

Segment operating income at $(31)m, including $(70)m impairments mainly related to multi-client library, and at $39m, a 14% margin, before them

Segment Free Cash Flow at $44m

Net Cash Flow was positive at $17m

Net loss of $(98)m, including $(27)m loss from Discontinued Operations and $(70)m impairments

Net debt at $540m before IFRS 16 and $705m after IFRS 16

Segment leverage at 0.8x Net Debt/LTM EBITDAs (excluding IFRS 16 impact)

Adjusting to an unprecedented crisis: focus on cost control and cash preservation

2020 Cash Capex around $300 million, down $(75) million vs. previous guidance of March 6, 2020:

2020 Multi-client cash capex, down $(60) million, at around $225 million at 75% prefunding rate

2020 Industrial and development costs cash capex around $75 million

Cash costs reduction of around $(110) million annualized and around $(35) million year on year.

*For full financial records, please reference the Investors section of this website.*

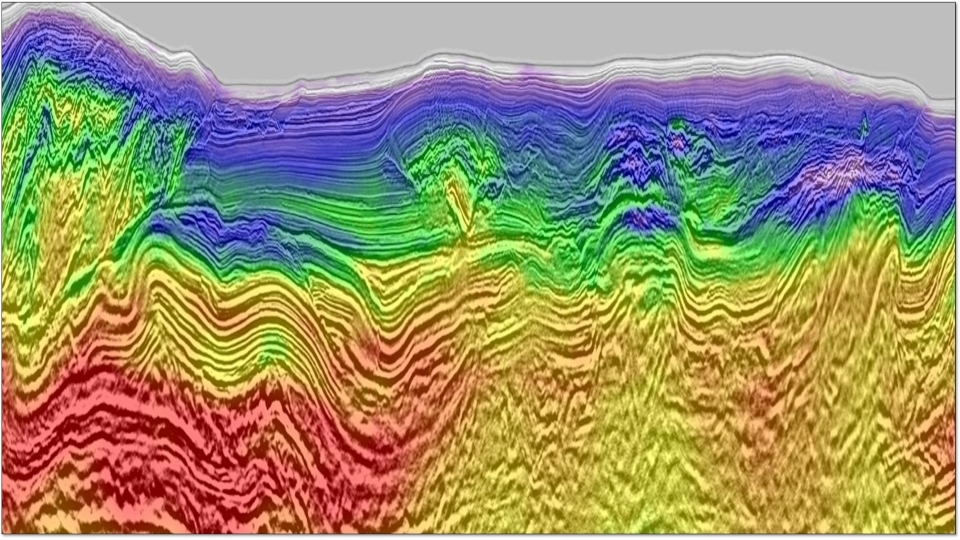

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).