CGG Announces Q2 2017 Results

Paris, France | Jul 28, 2017

Quarterly EBITDA boosted by solid multi-client sales

Revenue at $350m

-

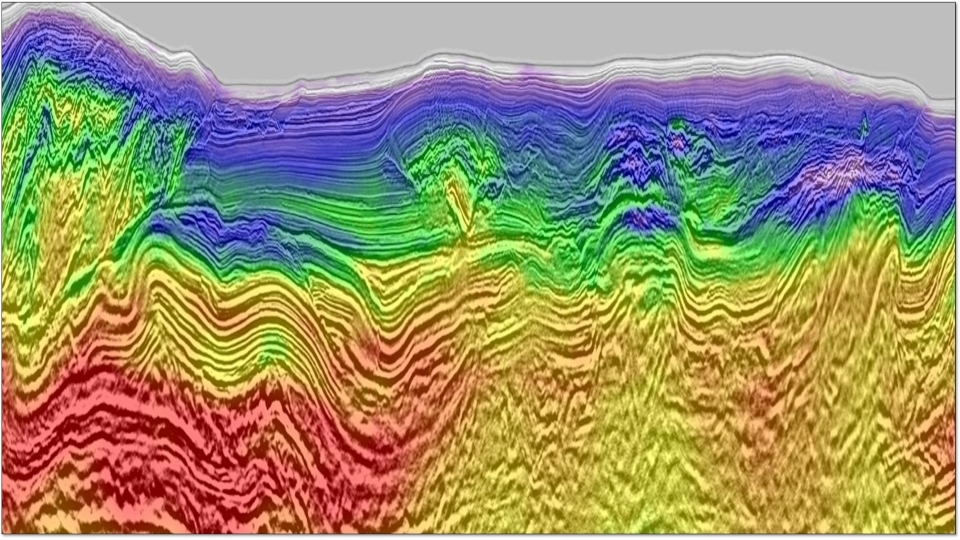

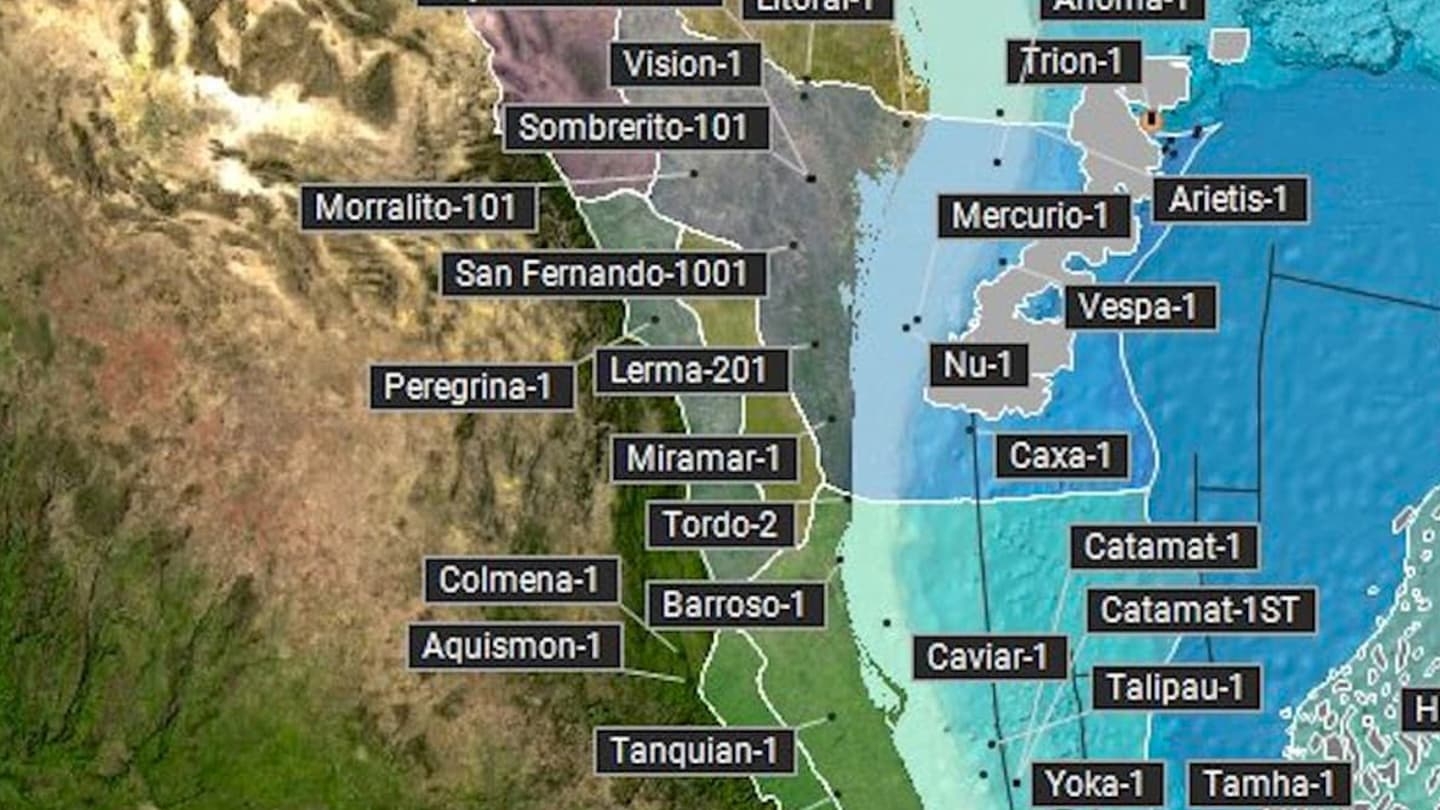

- GGR: solid Multi-Client quarterly sales boosted by Mexican and Brazilian licensing rounds

- Equipment: persistent low volumes

- Contractual Data Acquisition: good marine operational performance in very challenging market conditions

- EBITDAs1 at $120m

- Group Operating Income1 at $(3)m

- Capex at $78m and Free Cash Flow1 at $(24)m

- Net debt up at $2,497m at end of June with liquidity down to $315m

- Net income at $(170)m

2017 Market outlook unchanged

- 2017 operating results still expected in line with 2016, based on different mix:

- Multi-Client: sales supported by good positioning in key basins

- Equipment: low volumes in a context of uncertain recovery horizon

- Data acquisition: still hampered by low exploration spending with the usual unfavorable seasonality in H2

Focused on the swift delivery of our financial restructuring

- Nordic debt restructuring completed on April 20

- Company financial restructuring proposal on May 12

- Agreement in principle with a majority of secured lenders and a majority of unsecured lenders reached on June 2

- French Safeguard proceeding on CGG S.A. launched on June 14; creditors committee to be held in France on July 28

- Prearranged US Chapter 11 for 14 significant subsidiaries launched on June 14; creditors consultation to be completed in the US by mid-October

- Successful Private Placement Agreement of $375m new 2024 HYB: commitment period closed on July 7

- Financial restructuring plan to be approved by shareholders’ EGM to be held end of October; an essential step to ensure the future of the company

- $125m rights issue to follow

- Settlement of all restructuring operations early 2018

1 Figures before Non-Recurring Charges related to the Transformation Plan and data library impairment

Paris, France - July 28 2017 – CGG (ISIN: FR0013181864 – NYSE: CGG), world leader in Geoscience, announced today its 2017 second quarter unaudited results.

Commenting on these results, Jean-Georges Malcor, CGG CEO, said:

“This second quarter was characterized by the very continued commitment from our operational teams, ensuring a high quality service to our customers, and by major progress in our financial restructuring process.

Operationally, our solid $120 million EBITDA was driven by multi-client sales thanks to the good positioning of our data library. However, equipment sales were very low in a market with limited visibility and an uncertain recovery horizon. Our 2017 outlook is unchanged, with operating results in line with 2016 and downward pressure on cash flow generation as expected.

In parallel, we achieved progress in our financial restructuring process initiated early in the year, in agreeing a plan with a majority of our creditors. This balanced plan meets the objectives of the company: preservation of the Group’s integrity, massive debt reduction, extension of the debt maturities and providing additional liquidity. It enabled us to enter in prearranged Safeguard and Chapter 11 processes backed by the majority of our creditors, thus helping to protect commercially, operationally and socially the Company in this period of uncertainty.

Following the creditors’ committees vote in France expected today and with the approval of the creditors in the United States sought by mid-October, the next decisive step for CGG's sustainability will be the approval of the financial restructuring plan at the shareholders’ Extraordinary General Meeting scheduled for the end of October.

This proposed plan would result in a $2 billion net debt reduction and would provide the necessary liquidity to support the Company’s turnaround, while allowing shareholders to participate to the recovery.”

Post-closing event

- CGG announced on July 13 that Eligible Holders representing 86.08% of the aggregate principal amount of the Senior Notes had committed to subscribe to the new 2024 HYB pursuant to the terms of the private placement agreement, and had acceded to the lock-up agreement as at July 7 (the end of the placement period). As a reminder, the issuance of the new 2024 HYB has been totally backstopped by members of the ad hoc committee of the holders of the Senior Notes.

Furthermore, holders of 74.24% of the combined aggregate principal amount of the Senior Notes and the Convertible Bonds, together with holders of 77.66% of the aggregate principal amount of the group’s Secured Debt, have executed or acceded to the lock-up agreement. This indicates a high level of support for the Financial Restructuring and satisfies a key milestone in the implementation process ahead of creditors meetings in France and in the US.

*For full financial records, please reference the Investors section of this website.*

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).