CGG Announces Q3 2017 Results

Paris, France | Nov 13, 2017

Quarterly EBITDA sustained by solid multi-client sales

- Revenue at $320m

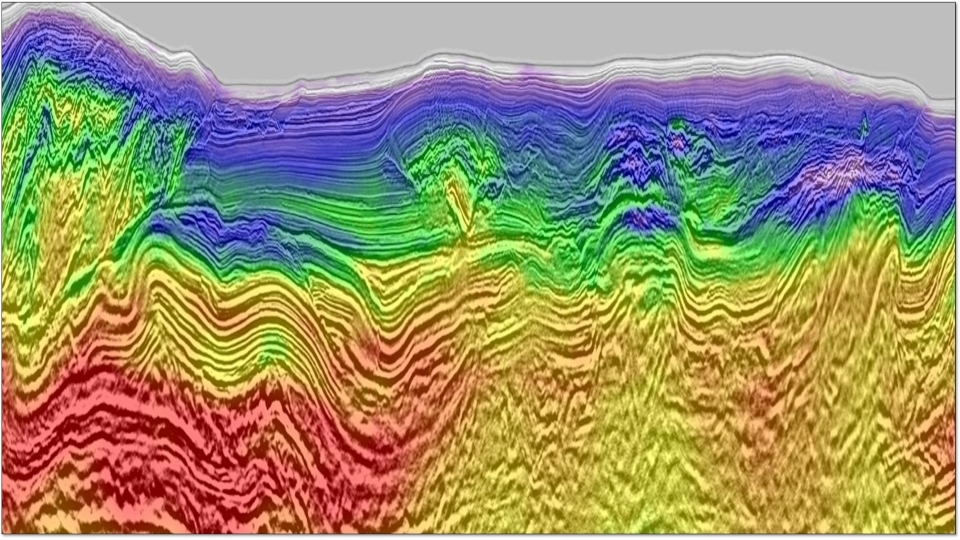

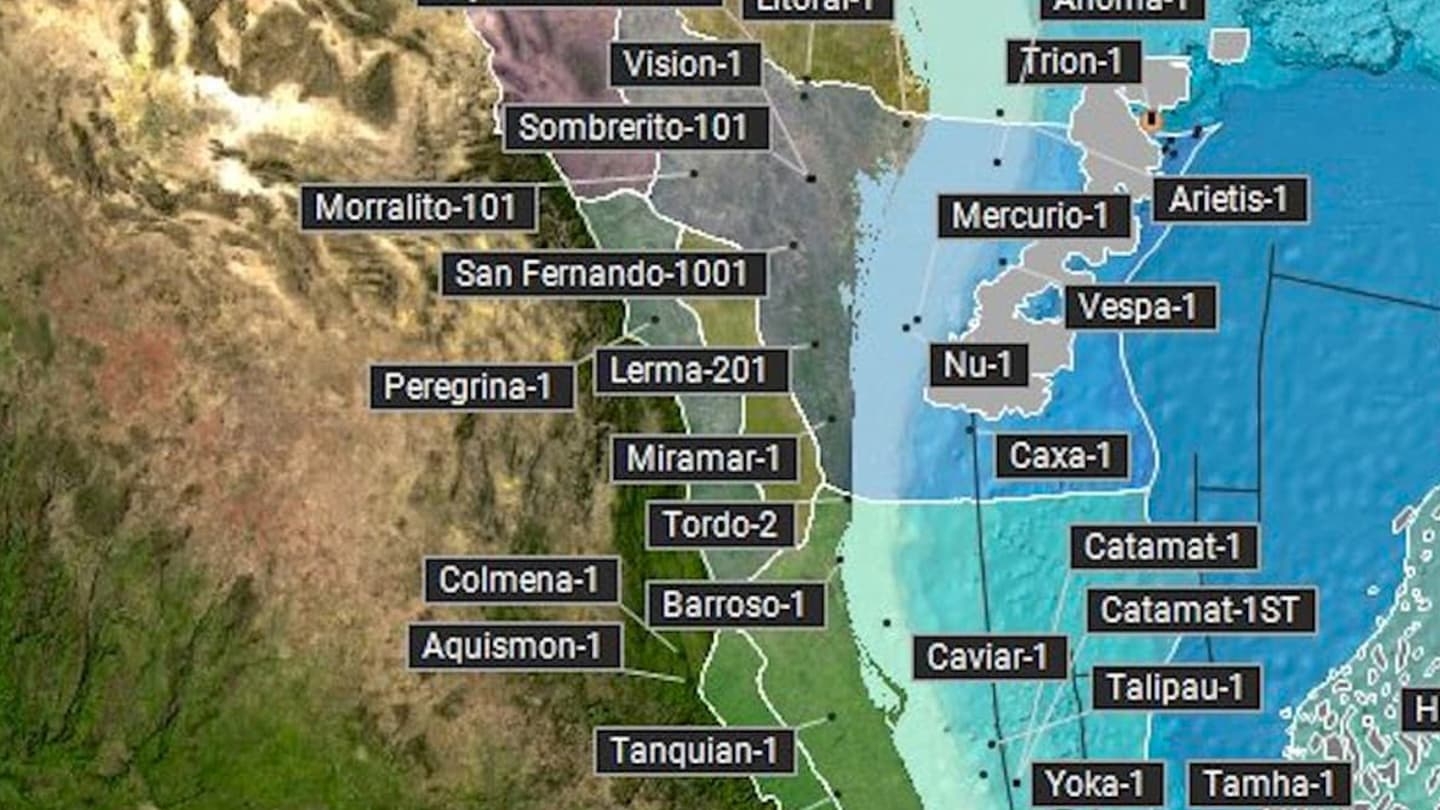

- GGR: solid Multi-Client quarterly sales boosted by Brazilian licensing rounds

- Equipment: persistent low volumes

- Contractual Data Acquisition: good operational performance in very challenging market conditions

- EBITDAs1 at $90m

- Group Operating Income1 at $(24)m

- Multi-client capex at $54m, 131% prefunded

- Other capex at $13m and Free Cash Flow1 at $(11)m

- Net income at $(124)m

Year-to-date results in line with our full year outlook

- Revenue at $919m, up 6% year-on-year

- EBITDAs1 at $238m, up 4% year-on-year

- Group Operating Income1 at $(95)m, up 34% year-on-year

- Multi-client capex at $162m, 121% prefunded

- Other capex at $50m and Free Cash Flow1 at $(109)m

- Net debt up at $2,571m at end of September with liquidity at $333m

- Net income at $(439)m

Financial restructuring plan

- July 28, lenders’ committee and bondholder general meeting approved the safeguard plan

- Late September, impaired classes of creditors validated the Chapter 11 plan in the US

- November 13, EGM on second notice for shareholders to approve the necessary resolutions for the implementation of the financial restructuring plan

- November 20, French commercial court hearing on safeguard plan and claim filed by some convertibles bondholders

- Subject in particular to the approval of the EGM and the sanctioning of the draft safeguard plan by the French commercial court , the financial restructuring plan should be implemented in Q1 2018

1 Figures before Non-Recurring Charges related to the Transformation Plan and data library impairment

Paris, France - November 13 2017– CGG (ISIN: FR0013181864 – NYSE: CGG), world leader in Geoscience, announced today its 2017 third quarter unaudited results.

Commenting on these results, Jean-Georges Malcor, CGG CEO, said:

“In a challenging geoscience market environment, the strong commitment from our teams, the operating performance in all activities and the strategic positioning of our multi-client library have allowed us to reach a revenue of $320 million and an EBITDAs of $90 million this quarter.

The year-to-date revenue were $919 million, up 6% from last year, despite still very low equipment sales. On this basis, we reiterate our 2017 outlook, with an EBITDAs level expected to be in line with 2016 and with lower cash flow generation.

In parallel, we achieved progress in our financial restructuring process initiated early in the year, in obtaining approval from lenders’ committee and bondholder general meeting in France on the safeguard plan on July 28th, and approval from the American Court on the Chapter 11 plan on October 16th.

The next decisive step for CGG's sustainability is the approval of the necessary resolutions to implement the financial restructuring plan at the shareholders’ Extraordinary General Meeting held today on second notice.

This proposed plan would result in a $2 billion net debt reduction and would provide the necessary liquidity to support the Company’s turnaround, while allowing shareholders to participate to the recovery.”

Post-closing event

- On October 13, 2017 we made available to the public a prospectus (in the French language, AMF visa n°17-551) in connection with certain issuances provided for under the draft safeguard plan and the Chapter 11 plan in the context of the financial restructuring plan of CGG. The prospectus comprises the CGG reference document (document de référence), filed with the Financial Markets Authority on May 1, 2017, the update of the Company’s Reference Document filed with the AMF on October 13, the securities note (including a summary of the prospectus) dated October 13, 2017, and a summary of the prospectus

- On October 16, 2017, the relevant U.S. Bankruptcy Court confirmed the Chapter 11 plan

- On October 17, 2017, a Securities Note Supplement was made available. It describes the undertaking of Bpifrance Participations to vote in favor of the resolutions required to implement the financial restructuring plan, as well as the related undertakings made by the Company and certain of its creditors in the context of the safeguard proceedings. It also specifies that the U.S.Bankrupcy Court has, on October 16, 2017, entered an order confirming the Chapter 11 plan

- On October 31, 2017, a quorum of 22.48% of the share capital was present at the General Meeting of shareholders, which allowed a vote on the ordinary part of the agenda, i.e. mainly approval of the 2016 consolidated annual financial statements. However, such representation was not sufficient to allow the general meeting to vote on the resolutions required to implement the financial restructuring plan. The required quorum for the extraordinary part of the general meeting on first notice is 25% of the share capital, and 20% on second notice

- CGG, the creditors who support the proposed restructuring plan, and DNCA agreed to maintain their undertakings in the Lock-Up Agreement, subject to the General Meeting of shareholders being held no later than November 17, 2017. An Extraordinary General Meeting of shareholders has been convened on second notice, on November 13, 2017, to vote on the resolutions required to implement the financial restructuring plan. Bpifrance Participations (which represents approximately 9.35% of the share capital and 10.9% of the voting rights) and DNCA (which represents approximately 7.9% of the share capital and approximately 7.8% of the voting rights) have undertaken to vote in favor of such resolutions

*For full financial records, please reference the Investors section of this website.*