CGG finalizes the implementation of its financial restructuring plan

Paris, France | Feb 21, 2018

CGG announces that on 21 February 2018 it finalized the implementation of its financial restructuring plan, which meets the Company’s objectives of strengthening its balance sheet and providing financial flexibility to continue investing in the future. This plan comprised (i) the equitization of nearly all of the unsecured debt, (ii) the extension of the maturities of the secured debt and (iii) the provision of additional liquidity to meet various business scenarios.

Regarding the finalization of the implementation of the financial restructuring plan, Jean-Georges Malcor, CEO of CGG, said: “Today marks the completion of our financial restructuring initiated more than a year ago. I would like to thank all stakeholders and notably the shareholders for their trust. This success was also made possible thanks to the continuous support of our customers and the daily commitment of the Group’s employees throughout this difficult period.

Following completion of all the transactions provided for in the financial restructuring plan, CGG now benefits from a restored balance sheet with a level of gross financial debt reduced to approximately $1.2 billion and a net financial debt / EBITDAs1 2017 ratio estimated to be less than 2x, immediately after completion of the transactions.

CGG is now an integrated Geosciences group, with leading technological positions that are fully adapted to its clients’ new needs, and which looks to the future with confidence and determination.”

As part of the implementation of its financial restructuring plan, the Company issued on 21 February 2018:

• $663.6 million in principal amount of first lien secured senior notes due 2023, bearing floating rate interest at Libor (floor of 1%) + 6.5% in cash, and 2.05% paid-in-kind (PIK) (issued by CGG Holding (U.S.) Inc.) in exchange for the balance of the Secured Loans taking into account an upfront paydown of US$150 million;

• $355.1 million and €80.4 million in principal amount of second lien secured senior notes due 2024, bearing floating rate interest at Libor (floor of 1%) + 4% in cash, and 8.5% paid-in-kind (PIK) (issued by CGG SA) (comprising $275 million and €80.4 million as new money and $80.2 million in exchange for part of the accrued interest claims under the Senior Notes (with the US$ new money notes and accrued interest notes being fungible);

• 71,932,731 shares of the Company (the “New Shares”) each with one share purchase warrant (the “Warrants #2” and together with the New Shares, the “ABSA”), all of which were subscribed by holders of preferential subscription rights;

• 35,311,528 new shares resulting from the equitization of the Convertible Bonds;

• 449,197,594 new shares resulting from the equitization of the Senior Notes;

• 22,133,149 warrants allocated to the shareholders of CGG (the “Warrants #1”);

• 113,585,276 warrants in favor of the subscribers to the Second Lien Notes (the “Warrants #3”);

• 7,099,079 warrants allocated to the members of the ad hoc committee of holders of Senior Notes (the “Coordination Warrants”);

• 10,648,619 warrants allocated to the members of the ad hoc committee of holders of Senior Notes (the “Backstop Warrants”).

1 EBITDAs before restructuring costs linked to the Transformation Plan

The table in Appendix 1 sets out some of the key characteristics of the respective warrants.

The Senior Notes and the Convertible Bonds have been delisted from the Euro MTF market of the Luxembourg Stock Exchange and Euronext Paris, respectively.

For the purpose of this press release:

“Senior Notes” means, together, (i) the high yield notes, bearing interest at a rate of 5.875% and maturing in 2020, issued by the Company on 23 April 2014, (ii) the high yield notes, bearing interest at a rate of 6.5% and maturing in 2021, issued by the Company on 31 May 2011, 20 January 2017 and 13 March 2017, and (iii) the high yield notes, bearing interest at a rate of 6.875% and maturing in 2022, issued by the Company on 1 May 2014;

“Convertible Bonds” means, together, (i) the convertible bonds (obligations à option de conversion et/ou d’échange en actions nouvelles ou existantes), bearing interest at a rate of 1.75% and maturing on 1 January 2020, issued by the Company on 26 June 2015, and (ii) the convertible bonds (obligations à option de conversion et/ou d’échange en actions nouvelles ou existantes), bearing interest at a rate of 1.25% and maturing on 1 January 2019, issued by the Company on 20 November 2012;

“Secured Loans” means, together, (i) the revolving credit agreement entitled “Multicurrency Revolving Facility Agreement”, entered into by the Company on July 31, 2013 for an initial principal amount of $325,000,000, currently drawn in full and repayable at the latest on 15 July 2018 (ii) the revolving credit facility agreement entitled "Credit Agreement" entered into by CGG Holding (US) Inc. on 15 July 2013 for an initial principal amount of $165,000,000, currently drawn in full and repayable at the latest on 15 July 2018 and (iii) a term loan agreement entitled "Term Loan Credit Agreement" entered into by CGG Holding (US) Inc. on 19 November 2015 for an initial principal amount of $342,122,500, repayable at the latest on 15 May 2019.

2 The 24,996 Warrants #1 allocated to the Company in connection with the treasury shares were cancelled.

3 Subject to extension cases provided for in section 4.8 of the securities note dated 13 October 2017, as for Warrants #3, Coordination Warrants and Backstop Warrants.

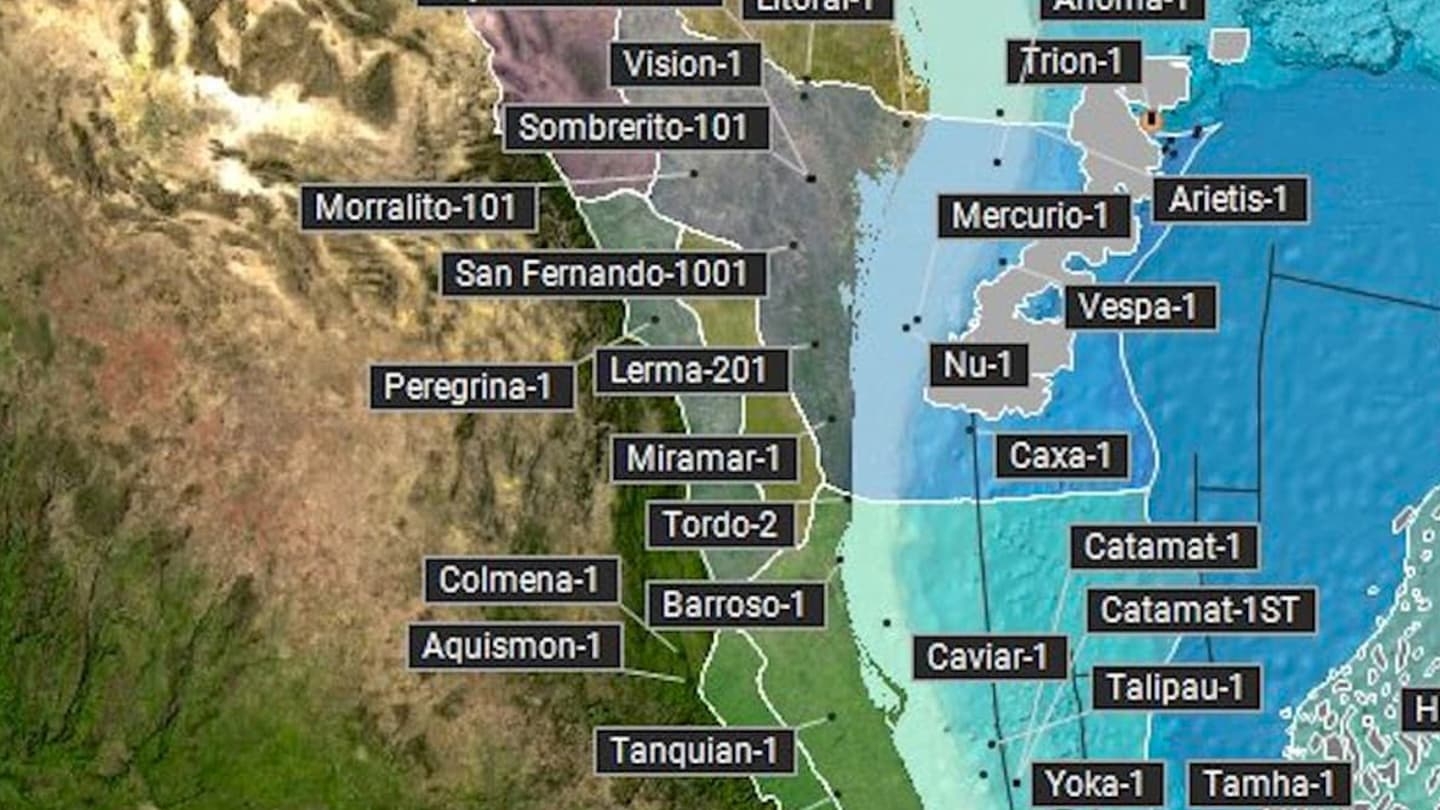

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).