CGG Presents its 2021 Strategic Roadmap

Paris, France | Nov 7, 2018

Leading through Change

CGG (ISIN: FR0013181864) world leader in Geoscience, is holding a Capital Market Day today in London to provide an update on its strategic vision intended to ensure its future growth and sustainability.

Sophie Zurquiyah, CGG CEO, said:“Our strategic roadmap is focused on ensuring that CGG can produce sustainable returns through the cycles and deliver profitable organic growth. These objectives will be accomplished by transforming CGG into an asset-light People, Data and Technology Company, and furthering the leadership of our three core differentiated businesses: Geoscience, Multi-Client and Equipment, along with developing new areas for capital-efficient profitable growth. This will enable CGG to best meet the exploration, development and production needs of our clients, position the company to bring significant value to our shareholders and create a sustainable workplace for our employees.”

2021 Financial Targets

- Segment revenue at $1.7b, +/- 5% with more than 30% coming from new offerings

- Segment EBITDAs margin at 45% +/- 300bps

- Segment OPINC margin at over 15%

- Segment Free Cash Flow of $300m +/-10%

- Financial leverage (Net Debt / EBITDAs) below 1x

2021 Strategic Roadmap

- Profitable through the cycles

- Transition to an asset light model: Significantly reduce CGG’s exposure to the Acquisition business

- Lean cost base: Reduce G&A and support costs by $40m by 2021

- Optimize capital structure and increase cash generation

- Strengthen leadership positions

- Geoscience: 2017-2021 revenue CAGR of 9% - 12%, strengthen leadership position and profitability

- Multi-Client: 2017-2021 revenue CAGR of 7% - 10%, cash on cash ratio over 1.5x

- Equipment:2017-2021 revenue CAGR of 27% - 30%, incremental OPINC margin over 25%

- New areas of profitable organic growth

- Increase participation across the E&P value chain in development & production

- Develop adjacent businesses, leverage digital technologies/digitalization and expand Equipment through diversification

- Estimated Implementation costs

- All contemplated actions and implementation are subject to all legal requirements.

- Cash impact up to $(200-250)m, over 2019-2021, with a 2.5 to 3-year payback

- P&L impact up to $(400-450)m, over Q4 2018 – 2021

CGG 2021 Strategic Roadmap

CGG’s 2021 financial targets are underpinned by a comprehensive strategic roadmap for profitable growth that is structured around three business imperatives:

- Profitable through the cycle

Transition to an asset-light model by reducing CGG’s exposure to the data acquisition business, which has been impacted over the years by structural industry overcapacity, lack of differentiation, commodity pricing and a heavy fixed cost base. CGG therefore plans to carry out the following strategic changes in compliance with all legal requirements.

- Marine:

- Adjust to a 3-vessel fleet in 2019.

- Find a strategic partnership to cost efficiently operate and control the vessels.

- Land: exit the market after a wind-down period.

- Multi-Physics: market for sale, and monetize when suitable.

- Strengthen leadership positions

Become a people, data and technology company by further strengthening the CGG’s core profitable businesses: Geoscience, Multi-Client, and Equipment, which perform well through the cycles and can best capture the market rebound.

Geoscience maintained both its leading market share and margins through the downturn, based on clear differentiation that clients recognize and value. The CGG strategy going forward is to further strengthen its leadership position as the market recovers. This will be achieved through recruiting and developing talents, investing in algorithms and computer technology and surpassing our clients’ expectations.

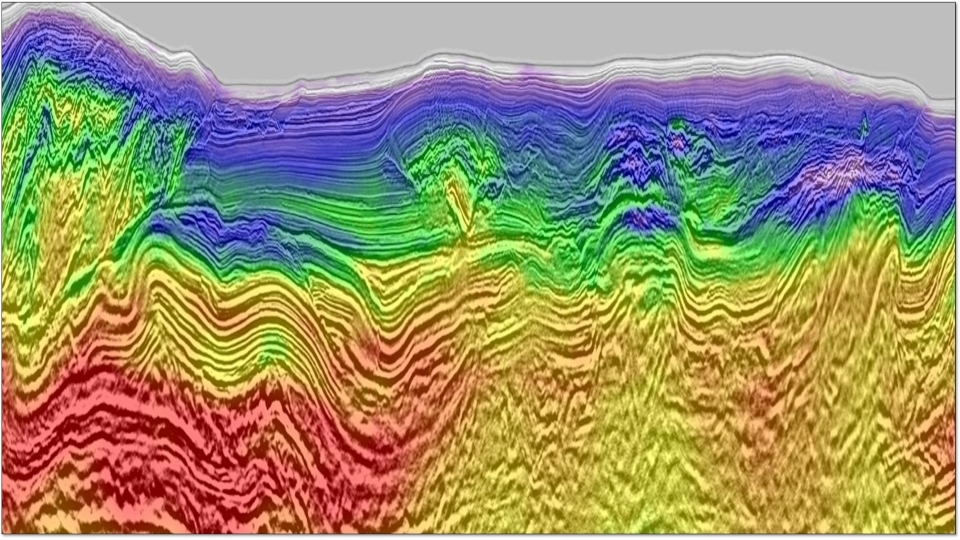

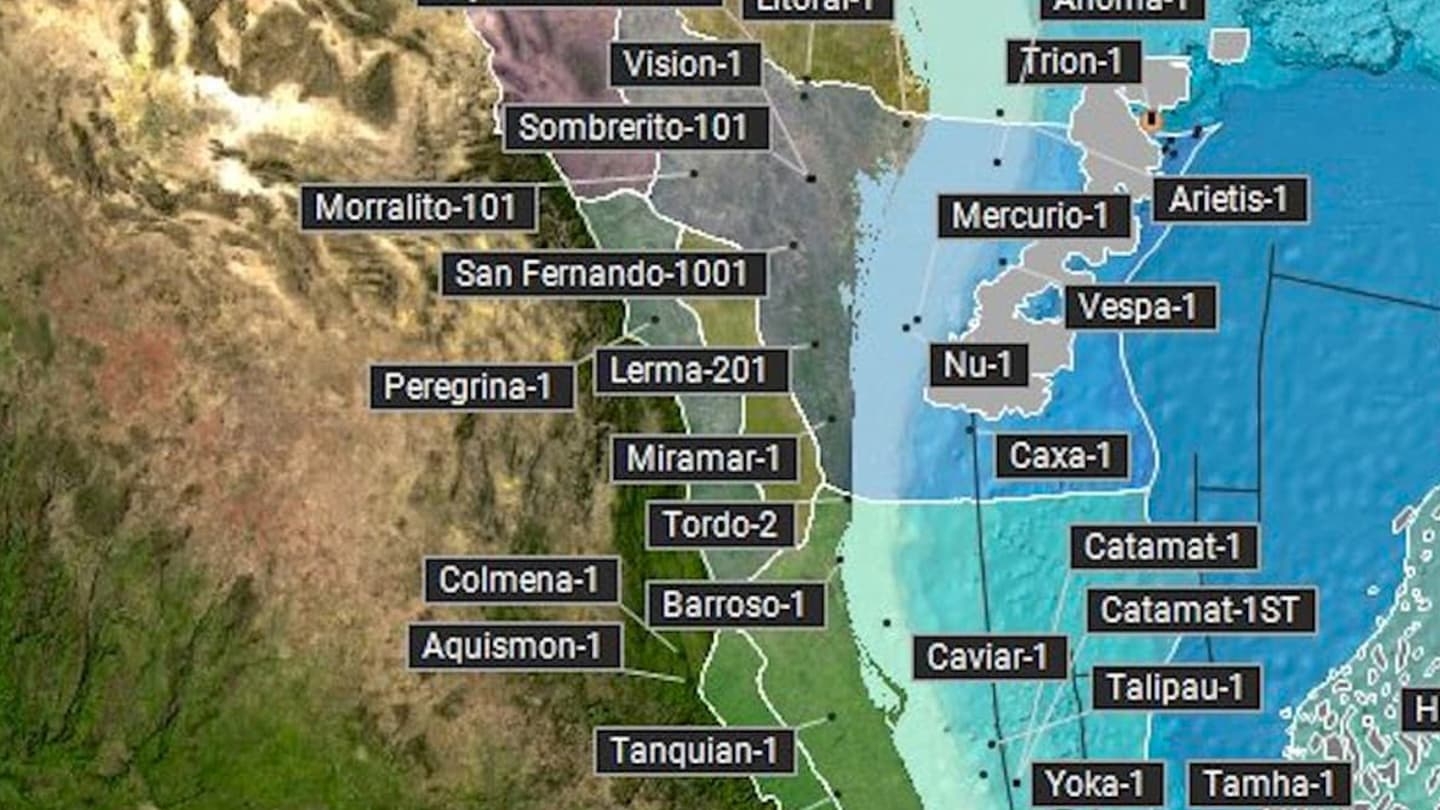

Multi-Client also performed well through the cycle and since 2017 has seen signs of a strengthening offshore exploration market. The strategic path will give this business freedom to select the providers of acquisition services best suited for their project requirements and enable the delivery of a full suite of products, from wells and geology to 2D/3D seismic and integrated packages that will greatly improve exploration efficiency.

Equipment has the manufacturing flexibility required to offset the impact of industry cycles, while maintaining the R&D investments and resources necessary to capture the rebound. Looking forward, as the market continues to strengthen, Equipment will benefit from its very large installed base in land. The marine market will also strengthen as a significant number of streamers need replacement. Gauges and downhole tools growth is driven by the US Land unconventional market, which continues to be strong.

- Develop new areas of profitable growth

Supporting the strategic targets of 30% of revenue coming from new offerings and leveraging the recovering offshore exploration market, CGG will develop new areas of profitable growth in a capital-efficient way. Areas of focus include expansion into adjacent markets, leveraging increased reservoir development activity, unconventional market, equipment diversification and rapid advance of geoscience and digital technologies.

The capital market day slideshow is now available on our website and the management presentation will be webcasted live starting at 10.00 am Paris time, 9.00 am London time on www.cgg.com

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).