Restructuring Update

Paris, France | May 12, 2017

On March 3, 2017, CGG S.A (“CGG” or the “Company”) entered into a financial restructuring process with the aim of significantly reducing debt levels and related cash interest costs to align them with its cash flows. In order to facilitate such restructuring discussions held under the aegis of a mandataire ad hoc, CGG has executed non-disclosure agreements (“NDAs”) and initiated discussions with (i) certain members of the ad hoc committee representing a majority in principal amount of the secured debt (the “Secured Lenders Coordinating Committee”), (ii) members of the ad hoc Committee representing c. 40 % of the aggregate principal amount of the Senior Notes (the “ad hoc Committee of Senior Notes”), (iii) the representative of the masses of holders of OCEANEs (Convertible Bonds) (who also holds c. 8.9% of the Convertible Bonds maturing in 2019 and c. 10.0% of the Convertible Bonds maturing in 2020), (iv) DNCA, a shareholder representing c. 7.9% of the share capital and c. 7.7% of the voting rights of the Company, as well as c. 19.1% of the aggregate principal amount of the Senior Notes maturing in 2020 and c. 20.7% of the Convertible Bonds maturing in 2020 and (v) two other significant shareholders, Bpifrance Participations representing c. 9.4% of the share capital and c. 10.8% of the voting rights of the Company and AMS Energie representing c. 8.3% of the share capital and c. 8.1 % of the voting rights of the Company, (collectively the “Stakeholders”).

Pursuant to the NDAs, CGG is required to publicly disclose, by May 12, 2017, the status at that date of the negotiations regarding the financial restructuring and certain previously confidential information, including selected financial targets and additional information on its business segments.

The presentation attached hereto, entitled “Overview of the Business Plan & Financial Restructuring Proposal” and posted on the Company’s investor website, summarizes the status of negotiations and (on pages 7 to 17) the previously confidential information referred to above, in particular certain information related to the Business Plan 2017-2019, which is being furnished to satisfy the Company’s obligations under the NDAs as well as its public disclosure obligations in respect of all material non-public information that has been shared with the Stakeholders in the course of discussions.

Jean-Georges Malcor, CEO of CGG, comments that “The discussions have been complex due to the significant efforts required from all the Stakeholders. The proposal put forward by us is in the corporate interest of the Company. It preserves the Group’s integrity and provides a framework for long-term sustainability for the Company’s businesses, employees and customers. This restructuring proposal relies on a significant deleveraging with a gross debt reduction from approximately $3 billion to approximately $1 billion through conversion into equity and provides the Company with the financial flexibility to address the various recovery scenarios. Shareholders have the option to take a significant part in the recovery of the Company post-restructuring, through the rights issue and the two proposed sets of warrants. The proposal is supported by several of our key Stakeholders. We are seeking to secure the support of additional Stakeholders to this comprehensive proposal.”

The trading of CGG shares and Convertible Bonds (Shares Code ISIN: FR 0013181864, Convertible Bonds maturing 2019 : FR 0011357664, Convertible Bonds maturing 2020 Code ISIN : FR 0012739548) will be suspended by Euronext until 12 May 2017, 3:30pm.

About CGG

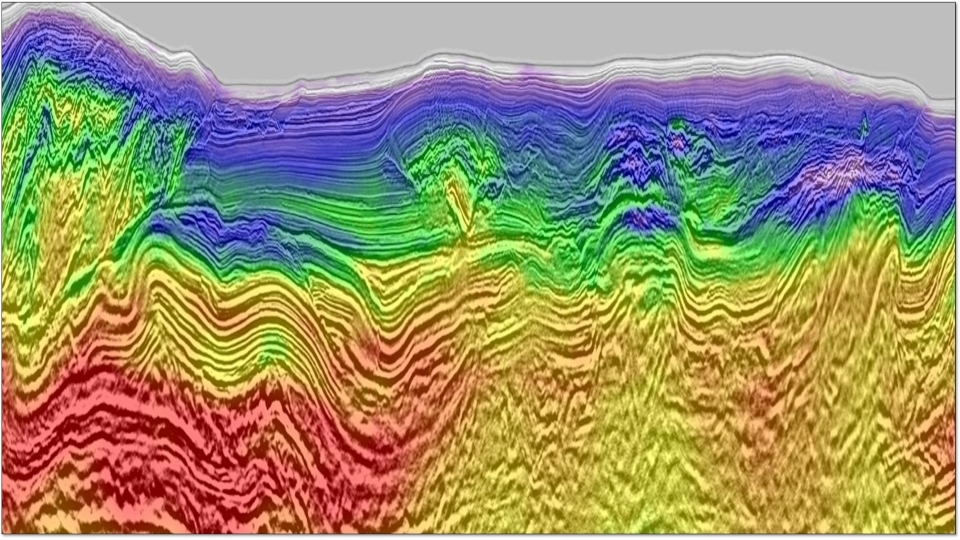

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).